Indies Capital sees post-Covid investment opportunities amid $100m Fund III first close

Singapore-based asset manager Indies Capital Partners has hit a $100m first close for its third private equity and structured credit fundraise.

Singapore-based asset manager Indies Capital Partners has hit a $100m first close for its third private equity and structured credit fundraise.

Spanish impact fund Fondo Bolsa Social has held a €10m first close and expects to raise total commitments of €25m.

Asia Pacific Village Group, an entity owned by the EQT Infrastructure IV fund, has made a new offer to acquire the retirement community manager for NZ$6 per share

Bain Capital's agreed buyout of coronavirus-stricken airline Virgin Australia could be under threat by bondholders attempting to make their own offer to creditors.

FRP has been hired by sports bar chain Rileys to assist in developing a rescue plan for the company, according to reports.

Cinven-backed Partner in Pet Food has agreed to wholly acquire Doggy, a Swedish dog and cat food producer, from Lithuanian investment company NDX Group.

Intriva Capital has acquired consumer credit and peer-to-peer lender Lending Works.

Searchlight Capital portfolio company Global Risk Partners (GRP) has acquired domestic healthcare broker Premier Choice Healthcare.

Andera Partners has held a first close on €80m for its Cabestan Croissance growth fund, which has now made its first investment with a capital injection for Forex Finance.

Bridgepoint Development Capital has agreed the SEK2.6bn ($280m) sale of European trade and customs management business KGH to industry major AP Moller - Maersk.

The real estate arm of global investment management and insurance group Principal has brought in veteran investor John Kropke as managing director of its US and European business.

The report comes as the finance sector looks to tackle a lack of racial diversity — part of a wider culture problem across the industry

Amber Infrastructure Group has boosted its European presence with a trio of new investment team hires.

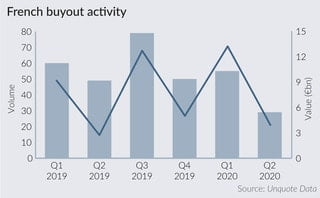

Even as France is now emerging from a stringent lockdown, the uncertain road ahead is threatening to undo months of improving activity and market sentiment. Mariia Bondarenko reports

The acquisition is on a cash and debt free basis, equivalent to a multiple of 16.3 times the group’s 2019 ebitda

Fundraising has remained strong as buyers raise ever larger capital pools

Three private equity firms share how they are looking to invest in infrastructure

The firm created by former Apollo executives is expected to help peer-to-peer lending company Lending Works scale up its operations to almost £1bn of lending each year by 2025

Triton-backed Eqos Energie has acquired the operating and office equipment of Austria-based electrical engineering company AML Elektrotechnik in an asset deal, following AML's insolvency filing in April 2020.

Spanish venture capital house Aldea Ventures has launched a VC fund-of-funds with a €100m target and €150m hard-cap, Unquote understands.

Recent Comments