Priveq Investment in the market for new $275m fund

Nordic private equity firm Priveq Investment is back in the fundraising market and is eyeing a $275m vehicle.

Nordic private equity firm Priveq Investment is back in the fundraising market and is eyeing a $275m vehicle.

Real estate private equity firm Rockpoint Group has secured $5.8bn across a pair of new fundraises.

Florida-based private equity firm Osceola Capital has closed its maiden fund after reaching its $125m hard cap.

Turkey Hill, a portfolio company of Peak Rock Capital, has acquired an ice cream production facility from Yarnell Ice Cream, a subsidiary of Schulze & Burch Biscuit Company. Turkey Hill produces iced teas, fruit drinks,

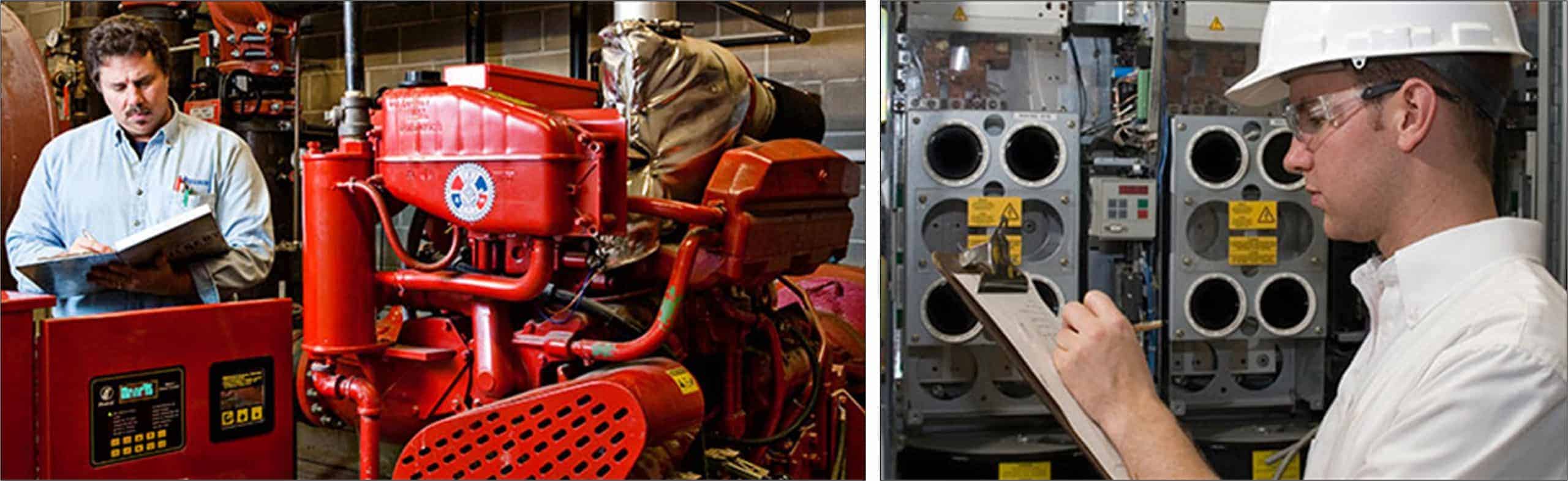

Therma Holdings, a portfolio company of Gemspring Capital, has acquired Gilbert Mechanical Contractors. Gilbert is Therma’s fourth acquisition since being acquired by Gemspring in June 2017. Gilbert is a provider of mechanical, electrical, plumbing, controls,

Tanknology, a portfolio company of Hamilton Robinson Capital Partners since September 2019, has acquired Compliance Testing & Technology (CCT). CCT is a provider of underground storage tank (UST) and aboveground storage tank (AST) compliance services,

Fulcrum Equity Partners has promoted Philip Lewis to partner. Mr. Lewis joined Fulcrum as an analyst in 2007. “We’re proud to announce Philip’s well-earned promotion to partner. Philip has grown tremendously both professionally and personally

Potential targets for buyouts include security-focused companies such as SecureWorks and A10 Networks, according to PitchBook

Many small businesses around the UK are struggling because of Covid-19, but a new survey from investment firm Connection Capital suggests that high net worth individuals would love to help. Having polled 233 of its

Swedish financial institutions SEB, AMF and FAM will invest SEK 3.5bn in a jointly owned company to support Swedish companies facing liquidity problems due to the coronavirus pandemic.

Italian private equity firm Gradiente has acquired three companies specialising in surface coating: Argos, Aalberts Surface Treatment Italy and Impreglon Italia.

Operationally focused middle market private equity firm the Sterling Group has closed its oversubscribed Sterling Group Partners V, LP fund at its $2bn hard cap. Most of the the money injected into Fund V was

Main Capital Partners-backed e-health software provider Alfa has acquired its Swedish peer Joliv.

83North has led a €30m series-B round for Germany-based robotics software developer Wandelbots, joined by new investors M12 (Microsoft's venture arm), and Siemens' VC unit Next47.

Ophthalmology company Rodenstock, a portfolio company of Compass Partners, has announced the completion of an equity capital increase of up to €75m from its existing investors.

IQ Capital has appointed Simon Hirtzel as general partner and chief operating officer.

Asabys Partners, alongside Alta Life Sciences, BPI France, Fund+ and Ysios Capital Partners, have invested in a €30m series-A round for drug development company Ona Therapeutics.

Zamo Capital has invested in investment manager Social and Sustainable Capital (SASC).

Online retailer of refurbished smartphones Swappie has raised $40m in a series-B round from existing investors Tesi, Lifeline Ventures, Reaktor Ventures and Inventure.

Philippe Deloffre and Aisling McCarthy join as managing directors in the Partnership Capital strategy

Recent Comments