Packing Pitchforks for the Hamptons

Along for an early morning “billionaire wake-up call” with protesters on Meadow Lane.

Along for an early morning “billionaire wake-up call” with protesters on Meadow Lane.

The Bolt-ons Digest is a compilation put together by Unquote with the main add-on deals announced by PE-backed companies in Europe over the last few days.

Five Arrows has sold Hygie31, a France-based pharmacy chain that includes low-cost brand Laf Sante, to Latour Capital in an auction preempted by the French sponsor.

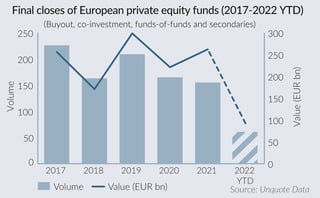

Amidst a crowded fundraising market and a tough macroeconomic environment, final closes of private equity funds in Europe to date in 2022 have struggled to keep up with the same period in 2021. However, a

Bain Capital has mandated Robert W. Baird and Barclays Capital to sell Dutch pram developer Bugaboo International, according to two sources familiar with the situation.

Fundraising patterns seem to be shifting, however, with GPs coming back in the market more frequently than in the past. Vincent Goupil, deputy head for placement agent activity at Jasmin Capital, tells us why this

Lightspeed Venture Partners has raised a mammoth $7bn of capital across a trio of funds for early and growth stage investments. The post Lightspeed closes fund trio with $7bn of committed capital first appeared on

Business and healthcare services-focused private equity investor Resolute Capital Partners has hit a target-beating $405m final close for its fifth flagship fund. The post Nashville’s Resolute beats target for fifth flagship fund targeting business, healthcare

KKR is in talks with the Australia and New Zealand Banking Group to divest software firm MYOB. Local media said the deal can be priced at over A$4.5bn ($3.04bn). The post KKR in talks with

Eurazeo has entered into exclusive negotiations with Apax Partners for the sale of its majority stake in Vitaprotech after four years of holding of the French security specialist.

Carlyle has agreed to sell a majority stake in US government procurement and supply chain software provider Unison to Madison Dearborn Partners, two years after buying back into the business it previously owned in the

Tech-focused investor Francisco Partners has raised a mammoth $17bn across its new flagship private equity fund and a new growth vehicle. The post Francisco Partners cements place among private equity giants with $17bn double fundraise

Dallas-based buyout house Crossplane Capital sealed a rapid return to fundraising by beating its $325m target for its second fund. The post Crossplane races to over $325m for Fund II final close, just two years

Consumer-focused private equity major L Catterton has launched a new private credit platform, bringing in industry veteran Shahab Rashid to jointly lead the unit. The post L Catterton launches private credit platform, Adams Street’s Rashid

Financial services-focused private equity house Stone Point Capital has raised $9bn for the hard cap close of its biggest-ever fund. The post Stone Point surges to $9bn hard cap for massive new financial services-focused fundraise

US-headquartered technology-enabled financial and business services investor Motive Partners has raised USD 2.54bn via a final close for Motive Capital Fund 2 and its affiliated co-investment vehicles.

Cinven has held a EUR 1.5bn final close for its Strategic Financials Fund (SFF), marking the GP’s debut vehicle in a strategy that will focuses exclusively on financial services investments.

Berlin-based insurtech platform Wefox has reached a USD 4.5bn valuation in a Series D round backed by existing investors, with sovereign wealth fund Mubadala leading the equity raise.

BC Partners is looking to exit IT Presidio at more than $4bn, including debt, Reuters reported quoting two people familiar with the matter. The post BC Partners looking at $4bn deal to divest IT company

UK-focused sponsor August Equity will look to raise its sixth fund towards the end of the year with a target of around GBP 400m, a source familiar with the situation told Unquote.

Recent Comments