Unigestion holds EUR 900m final close for fifth secondaries fund

Switzerland-based asset manager Unigestion has held a EUR 900m final close for Unigestion Secondary V (USEC V), surpassing its EUR 700m target.

Switzerland-based asset manager Unigestion has held a EUR 900m final close for Unigestion Secondary V (USEC V), surpassing its EUR 700m target.

Private equity firm Inflexion has acquired Irish contract manufacturing organisation (CMO) SteriPack.

IRIS Software majority owner Hg has appointed Goldman Sachs and Arma Partners to advise on an upcoming sale of the business, two sources familiar with the situation said.

August Equity has sold Amtivo, a provider of accredited certification to companies across 23 countries, to Charterhouse Capital Partners.

French mid-market private equity firm Adagia Partners has entered into exclusive negotiations to acquire dental prosthetics producer Minlay from Motion Equity Partners.

Asset manager Algebris Investments has held a EUR 200m first close for its Algebris Green Transition Fund, its first private equity fund. The vehicle will invest in Italian and Southern European businesses.

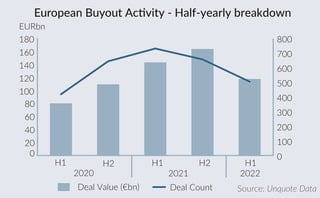

Following an almost too-good-to-be-true year in 2021, the outbreak of war in Ukraine and an impending recession are bringing a dose of realism to the world of private equity.

Infovista sponsor Apax Partners has launched a sale of the French network performance solutions group with Jefferies and Societe Generale advising the process, sources familiar with the situation said.

Private equity asset manager AlpInvest Partners is acting as the lead investor on Equistone’s single-asset continuation vehicle for Sicame, its French electricity distribution products and services provider.

Financial advisory firm William Blair is bolstering its financial advisory shop in Europe with five senior hires across technology, services, industrials and debt advisory.

Private equity firm Waterland has invested in Cooper Parry in a deal that will transform the UK tax and audit advisor from an LLP to a limited company.

Musk will take questions from employees as his $44 billion acquisition of the company moves ahead, despite his hand-wringing about bots.

NEW YORK, June 13, 2022 (GLOBE NEWSWIRE) -- Apollo (NYSE: APO) today announced that funds managed by its affiliates (the “Apollo Funds”) have agreed to acquire Cardenas Markets (“Cardenas”), a leading grocery retailer focused on

Gresham House Ventures has sold its majority stake in Media Business Insight (MBI), a UK-based content, insight, and events company for the creative media industry, in an off-market transaction to GlobalData, an AIM-listed data and

European GP Aurelius has sold Hammerl, a German manufacturer of blown film products, to construction material group Karl Bachl.

Early-stage venture capital firm 360 Capital has held a first close on its second French seed strategy at EUR 45m.

Israel Secondary Fund has raised its third fund totalling $312m, tripling its predecessor that was closed on $100m in 2017. The post Israel Secondary Fund triples predecessor to close new fund on $312m first appeared

The Board of the Pennsylvania State Employees’ Retirement System has picked Veritas Capital and Blackstone for its latest round of alternative asset fund commitments. The post PennSERS makes latest commitments to Veritas, Blackstone as it

HIG Capital’s distressed debt and special situations arm, HIG Bayside, has promoted Mathilde Malezieux to managing director. The post HIG promotes debt specialist Malezieux to managing director in Bayside arm first appeared on AltAssets Private

Blackstone and the Canada Pension Plan Investment Board have agreed the buyout of Genstar Capital’s Advarra, in a deal believed to value the business at about $5bn. Genstar and Linden Capital Partners will continue to

Recent Comments