Infusion for Health Secures $50 Million in Funding for Chronic Disease Management Platform

Aurelius has sealed it biggest deal yet by picking up McKesson UK in a £477m corporate carve-out from US healthcare company McKesson Corporation. The post Aurelius seals biggest deal yet with £477m carve-out of Lloyds Pharmacy

US private equity major GTCR has agreed the buyout of employee background screening specialist Cisive. The New York-based company provides screening and industry-specific data services to highly regulated, risk-sensitive sectors, with clients across segments including healthcare,

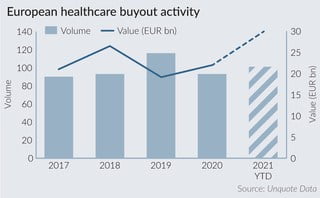

Private equity healthcare buyouts recorded so far in 2021 have reached a record aggregate value of EUR 29.9bn, according to Unquote Data.

Bain Capital has made a $300m investment in Polaris-backed Cardurion Pharmaceuticals through Bain Capital Life Sciences and Bain Capital Private Equity. The post Bain Capital joins Polaris to back cardiovascular treatment developer Cardurion in $300m

Despite lingering questions about the health of lenders' loan books, sponsors want in on banking businesses before greater confidence in asset quality and interest-rate hikes increase valuations. Pablo Mayo Cerqueiro reports

Pan European private equity firm IK Partners has acquired healthcare tube system supplier Plastiflex Group out of its €1.2bn Small Cap III Fund. The post IK Investment Partners taps €1.2bn Small Cap III Fund for

Levine Leichtman Capital Partners has continued a strong run of exits with the sale of home healthcare services franchise business Caring Brands International to Wellspring Capital Management. The post Levine Leichtman sells home healthcare franchise

Private equity titan Carlyle has backed clinical trial data management business Saama Technologies to expand its go-to-market capabilities and further investment in AI research and development. The post Carlyle buys into AI-embedded clinical trial data

Recent Comments