Harrison Street brings in de Pablo to spearhead European healthcare RE strategy amid trio of hires

Alternative real asset manager Harrison Street has made a trio of hires to strengthen its European investment and research teams.

Alternative real asset manager Harrison Street has made a trio of hires to strengthen its European investment and research teams.

Gridiron Capital has made an investment in Cubii, a direct-to-consumer fitness equipment company, in partnership with the company’s founders and management team. Cubii manufactures and sells compact seated elliptical exercise equipment and accessories. The Chicago-based

Susquehanna Private Capital (SPC) has made an investment in Authority Franchise Systems (AFS), a franchisor of pest control services to residential and commercial customers. AFS does business under the Mosquito Authority and Pest Authority brands

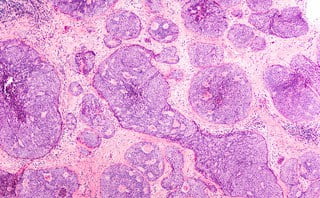

Novartis Venture Fund and Novo Holdings have co-led a €9m series-A funding round for Finnish developer of anti-cancer drugs Rappta Therapeutics.

Veteran venture capital firm Canaan Partners has scored another $800m fund close to wrap up capital raising for its 12 early-stage investment fund targeting healthcare and technology companies.

Gland Pharma, a subsidiary of Chinese conglomerate Shanghai Fosun Pharmaceutical Group, has started bookbuilding for its Indian IPO, set to be the largest pharmaceutical listing in the country.

India’s Emcure Pharmaceuticals has returned to the loan market after four years, seeking a small amount of $34m.

Pritzker Private Capital (PPC) has agreed to acquire Highline Aftermarket, the leading manufacturer of windshield wash fluids in the US and a portfolio company of The Sterling Group; and Warren Distribution, one of the largest

Shrieve Chemical Company, a portfolio company of Gemspring Capital, has acquired the styrene business unit and other assets of CLP Chemicals. Gemspring acquired Shrieve, a distributor of industrial chemicals, fluids, and specialty lubricants, in December

Brook & Whittle, a portfolio company of Snow Phipps, has agreed to acquire sister companies Innovative Labeling Solutions and Wizard Labels. Brook & Whittle is a Connecticut-headquartered manufacturer of pressure-sensitive labels, shrink labels and medical

New Mountain Capital has agreed the sale of health, retirement and HR advisory business OneDigital to Onex Corp after three years in its portfolio.

Kartesia has acquired a 51% stake in ADL Biopharma from its parent company ADL Bionatur Solutions, a Madrid-listed business that is controlled by Black Toro Capital.

Sabadell Asabys, VI Partners and CDTI Innvierte have led a €14m series-E round for Spanish healthcare device startup MedLumics.

Sweetwater Investment Management has held a hard cap, oversubscribed, and final close of its debut multi-client fund, Sweetwater Secondaries Fund II LP, with $350 million of capital. Sweetwater’s new fund invests in buyer-led secondary opportunities.

Recent Comments