Cowen leads $60.8m round for F2G

Cowen Healthcare Investments has led a $60.8m funding round for biotechnology company F2G.

Cowen Healthcare Investments has led a $60.8m funding round for biotechnology company F2G.

The deal would combine two healthcare billing and payment technology providers

Laxman Pai, Opalesque Asia: Robust fundraising and healthy demand from investors make the secondary market a bright spot for private equity in H1 2020. The global secondary market is now almost five times larger than

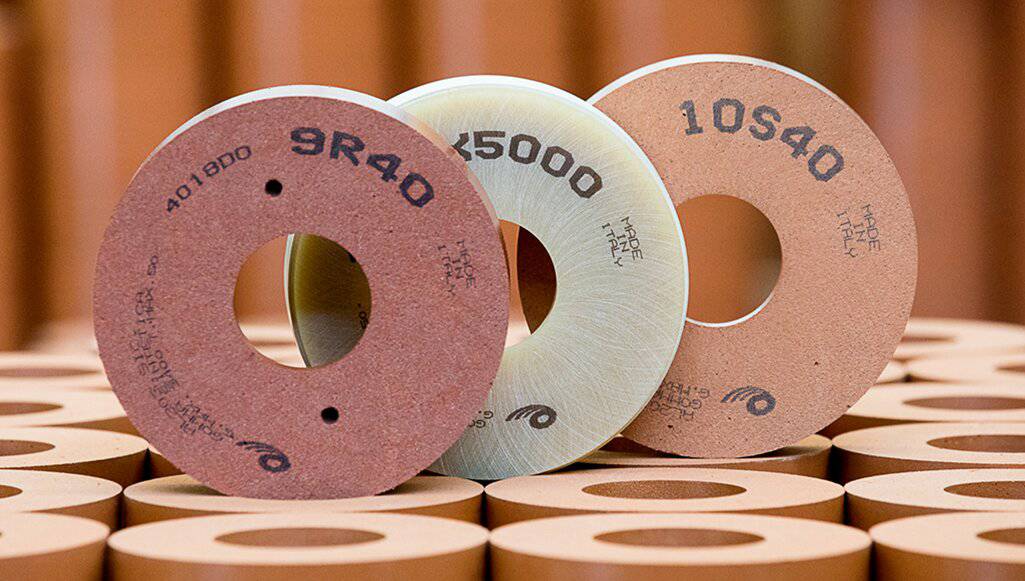

Astorg has agreed to sell its portfolio company Surfaces Group to TA Associates. Surfaces Group is a supplier of abrasive tools and consumables used in the manufacturing process of high-end materials. The group’s products are

Arsenal Capital Partners has completed the acquisition of AIM-listed healthcare consultancy Cello Health for a purchase price of £181.8m.

Genstar has acquired Sonny’s Enterprises, a manufacturer of car wash equipment and supplies, from Sentinel Capital Partners. Sonny’s is the largest manufacturer and distributor of conveyorized car wash equipment, parts and supplies in the world

EyeSouth Partners, a portfolio company of Shore Capital Partners, has acquired Retina Associates of Middle Georgia (RAMG). RAMG provides ophthalmology services for the treatment of diseases of the retina, macula, and vitreous. The practice is

The strategy will invest in UK SMEs, with a focus on healthcare, business and financial services and technology, media and telecommunications

Advent Life Sciences, Fountain Healthcare Partners, Forbion Capital Partners, OrbiMed and Longitude Capital have sold their stakes in menopause therapy developer Kandy Therapeutics to Bayer's women's health division.

Arsenal Capital Partners has completed a £181.8m buyout of healthcare-focused advisory firm Cello Health.

Alvarez & Marsal (A&M) has added James Marceau as a managing director in its private equity performance improvement group. Mr. Marceau will be active within A&M’s aerospace, defense and aviation practice and will be based

Singapore-based special purpose acquisition company (Spac) Aspirational Consumer Lifestyle Corp is looking to raise $225m from a listing on the New York Stock Exchange.

TruFood Manufacturing, a portfolio company of AUA Private Equity since June 2019, has acquired Simply Natural Foods. Simply Natural is a co-manufacturer of confection products including sugarfree, organic, and kosher functional bars (products that include

Blackstone has agreed to acquire Ancestry from Silver Lake, GIC, Spectrum, and Permira at an enterprise value of $4.7 billion. The buy of Ancestry is the first control acquisition for Blackstone Capital Partners VIII LP

Dieter von Holtzbrinck Ventures (DvH Ventures) has announced the launch of its first Digital Health fund, which has held a first close on €60m.

Recent Comments