Volpi hires Fairlie from Synova

Volip Capital, a tech specialist mid-market private equity firm, has hired Scott Fairlie from Synova.

Volip Capital, a tech specialist mid-market private equity firm, has hired Scott Fairlie from Synova.

Private equity major Advent International and Primavera Capital are said to be considering to back Singapore-based Coda Payment at a valuation of $2.5bn. The post Advent, Primavera consider backing Singapore-based Coda Payment at $2.5bn valuation

Paris-headquartered EMZ Partners has acquired a majority stake in Germany-based FotoFinder Systems, a medical skin imaging systems developer

Buyout majors GTCR and CD&R have expressed interest in acquiring US medical device manufacturer Merit Medical Systems, Reuters reported quoting people familiar with the matter. The post GTCR, CD&R said to be after US medical

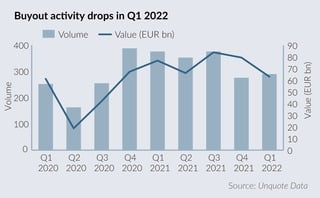

Private equity investment in Europe saw a notable drop in first quarter of the year amid major geopolitical and macroeconomic headwinds, Unquote Data shows.

Sweden-based private equity firm Accent Equity has acquired a majority stake in European commercial interior designs solutions provider Norcospectra from SEB Private Equity as well as other minority shareholders.

Irish private equity firm Melior Equity Partners has closed the largest-ever private equity funds in the state collecting €160m for Fund II. The post Carlyle spun-out Melior Equity Partners raises one of the largest PE

Ganni sponsor L Catterton has appointed Lazard to explore a sale, two sources familiar with the situation said.

Bridgepoint has entered exclusive negotiations to acquire French dental group Dentego from G Square as part of a sale process organised by Lazard, according to four sources familiar with the matter.

Fund-of-funds manager Munich Private Equity Partners (MPEP) has held a further close for Munich Private Equity Partners IV (MPEP IV) with more than EUR 215m in commitments.

Phoenix Equity Partners has sold UK-based holiday cabin business Forest Holidays to holiday lettings agency Sykes Holiday Cottages, a portfolio company of Vitruvian Partners and Livingbridge.

Sun European Partners has agreed to sell C&K, a manufacturer of high-quality electromechanical switches, to trade buyer Littelfuse at a $540m valuation. The post Sun European Partners sells C&K for $540m after almost doubling company’s

Altor is preparing to exit Transcom, a Sweden-headquartered business process outsourcing (BPO) services provider, through a dual-track process, two sources familiar with the situation said.

Global private equity giant KKR had reportedly raised more than €6bn for the first close of its latest European buyout fund. The post KKR said to pass €6bn in first close of latest hefty European

A pair of private equity majors have teamed with Canadian pension giant CPPIB to launch an improved €2bn takeover of property-focused German financer Aareal Bank. The post PE pair, CPPIB back with improved Aareal Bank

Buyout groups Hellman & Friedman (H&F), EQT and Permira have discussed the prospect of exploring a bid to take Scout24 private, two sources familiar with the matter said.

TSG Consumer Partners has agreed to buy a majority stake in fine art and valuables storage, moving and shipping specialist Cadogan Tate. The post Fine art, valuables storage and shipping specialist Cadogan Tate bought by

Private equity firm TSG Consumer Partners has agreed to acquire a majority stake in Cadogan Tate, a UK-based valuables transportation provider, from H2 Equity Partners

Healthcare-focused private equity house Havencrest Capital Management has beaten its target for its second fund thanks to strong performance from its debut investment vehicle. The post Strong Fund I performance helps healthcare-focused Havencrest beat $300m

Early Spotify and Delivery Hero backer Lead Edge Capital has raised over $1.95bn for the final close of its sixth fund, more than double the amount it collected for Fund V. The post Lead Edge Capital storms past $1.95bn for

Recent Comments