Vast majority of LPs plan to increase impact allocations – survey

Almost three quarters (72%) of LPs intend to increase their allocations to sustainability and impact investment within the next two years, according to a survey by HarbourVest.

Almost three quarters (72%) of LPs intend to increase their allocations to sustainability and impact investment within the next two years, according to a survey by HarbourVest.

AE Industrial Partners has made an equity and debt investment in Fire Team Solutions, a provider of mission-critical tech services to the US intelligence community. The post AEI taps $400m-targeting equity, debt fund to back

Startup Wise Guys (SWG), an Estonia-based accelerator and venture capital firm, is in the process of raising up to EUR 52.5m for its Cyber Fund I, its second Challenger Fund and its Opportunity Fund II,

But the Biden administration sent only a deputy commerce secretary to the high-profile gathering, amid shifts in global politics and diplomatic strains.

Gideon Gratsiani The Foreclosure and Auction Expert at CRE-Pro, LLC, a diversified private equity firm based in Miami, has announced that a subsidiary has acquired Glenville Towne Center located in...(PRWeb October 30, 2021)Read the full

Moody s warns of systemic risks in private credit industry From FT: The burgeoning private credit industry of lending to buyout groups has grown to about $1tn, but opacity, eroding standards and the difficulty in

Vauban Infrastructure Partners has agreed to acquire Norwegian public transportation operator Boreal Holdings from China Everbright Ltd. The post Vauban to acquire Norwegian public transportation operator Boreal to strengthen Nordic presence first appeared on AltAssets

Mid-market European tech investment house Volpi Capital has bought into UK driving feedback app Lightfoot. The post Volpi Capital buys into UK ‘Fitbit for cars and vans’ software developer Lightfoot first appeared on AltAssets Private

Global buyout giant Blackstone has agreed to acquire Australian clinical trials provider Nucleus Network. The post Blackstone to acquire Australian clinical trials provider Nucleus Network eyeing increasing demand from offshore biotech companies first appeared on

The New York State Common Retirement Fund has committed over $210m towards Asia Alternatives' New York Balanced Pool Asia Investors IV. The post NYSCRF puts over half of its new private equity commitments in Asia

Opalesque Industry Update - ITERAM Capital SA, an independent alternative asset manager, announced that the company has strengthened and expanded its alternative team. This double hire underlines ITERAM's strong commitment to a rigorous institutional framework

Opalesque Industry Update - Investor flows show CTA appeal in Q3 moving into Q4: HFM's Managed Futures Index finished Q3 up 7.6% YTD following a -0.3% return in September. The Q3 result leaves it trailing

Procuritas has invested in Sweden-headquartered headless guitar producer Strandberg Guitars.

Asia-focused alternative asset manager PAG is aiming to raise $9bn for its biggest buyout fund to date. If successful, the vehicle would be 50% bigger than the $6bn Fund III closed in 2019. The post

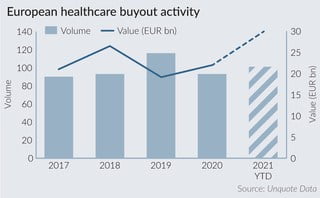

Private equity healthcare buyouts recorded so far in 2021 have reached a record aggregate value of EUR 29.9bn, according to Unquote Data.

Recent Comments