Aura Raises a $200 Million Series F at $2.5 Billion Valuation, Led by Madrone Capital Partners

Laxman Pai, Opalesque Asia: Quantitative hedge fund and CTA pioneer Aspect Capital has unveiled a new systematic momentum-based investment strategy focused on Chinese financial and commodities futures. A press release f...Article Link

Afinum Beteiligungsgesellschaft has sold its stake in human-machine interface (HMI) software and hardware developer Garz & Fricke (G&F) in a EUR 180m trade sale to listed Italy-based Seco.

Private equity-backed enterprise software business Informatica is eyeing a return to the stock market which could see it valued at up to $9bn. The post PE-backed Informatica eyes $9bn valuation in stock market return first

€20bn-managing investment firm Antin Infrastructure Partners has agreed to buy into US renewable energy platform Origis Energy. The post Antin Infrastructure taps €6.5bn Fund IV to buy into US renewable energy platform Origis Energy first

Gryphon Investors has agreed to buy nutritional supplement company Metagenics from Alticor Inc. The post Gryphon ends years-long search for nutrition investment with Metagenics buyout first appeared on AltAssets Private Equity News.

Phoenix Equity Partners has enjoyed a strong run of exits over recent months, while also pushing its 2016 fund closer to full deployment. Greg Gille catches up with managing partner David Burns to discuss recent

Alternative investment major Ares Management has hit a $5.1bn final close for its new private credit fundraise, surging past its initial $4bn goal. The post Ares passes $5bn to close new private credit fund well

ACON Investments has created a new major player in the sustainable scallop and lobster industry through the buyout and merger of Northern Wind, Suncoast Seafood and Raymond O'Neill & Son Fisheries. The post ACON creates sustainable

London-based mid-market-private equity house A&M Capital Europe has agreed to buy a majority stake in tech and engineering services provider Ayesa. The post A&M Capital Europe agrees Ayesa buyout, company plans to double turnover over

Spanish asset management house Alantra has held a €132m close for its private debt real estate fund, exceeding its initial target of €100m. The post Alantra beats target to close €132 private debt real estate

European private equity dealmaking has hit a new annual record with three whole months of the year to go, with a surge in deal volume behind the outstanding figures, new research shows. The post Record

European buyout house Equistone Partners has completed the acquisition of European aluminium gates manufacturer Gardengate. The post Equistone buys into aluminium gate maker Gardengate after recording 18% CAGR over the past five years first appeared

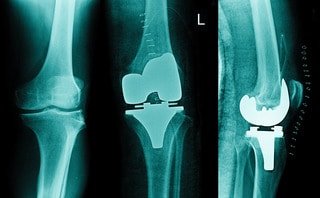

Private equity firm EQT has kicked off the sale of portfolio company LimaCorporate, according to five sources.

Argos Wityu could revisit the sale of portfolio company Fabbri Vignola in 12-18 months after shelving a process to exit the Italian fresh food packaging company late last month, according to several sources.

Unilever is expected to collect second-round bids for its black-tea business next month, with a number of private equity firms in the fray, according to two sources familiar with the situation.

Hawksmoor, a UK-based restaurant chain, and brewer Brewdog have both paused plans for their initial public offerings, citing pandemic recovery uncertainty in the hospitality sector.

Recent Comments