Carlyle doubles its stake in Swiss refiner Varo Energy

The firm acquired the 33% stake owned by Dutch investment company Reggeborgh and now owns 66% of the business

The firm acquired the 33% stake owned by Dutch investment company Reggeborgh and now owns 66% of the business

Used-car trading platform Auto1, which is backed by VCs including Softbank and Target Global, has announced it has set its final offer price at €38 per share ahead of its IPO on the Frankfurt Stock

Private equity giant Carlyle has teamed with with Brighton Park Capital to invest in Bangalore-headquartered enterprise healthtech solutions provider Indegene.

Life science investor Abingworth has upped the ante yet again with its 13th fundraise by hitting a $465m final close for the fund.

Opalesque Industry Update - Wilshire announced the launch of a new Powered by Wilshire index, the Hypatia Women Hedge Fund Index. Created and owned by Hypatia Capital, calculated and maintained by Wilshire, the index is

Queen's Park Equity has hit a £185m hard cap final close for its debut fundraise, beating its initial target despite the pressures of the Covid-19 pandemic.

Nordic Capital has bought and merged two of the Scandinavia region's online comparison sites for personal finance, Sambla and Advisa.

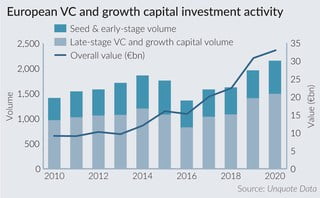

The European VC market has quietly kept on building a head of steam in the past 12 months, regardless of a pandemic that otherwise threatened to cripple entire sections of the private equity industry, Unquote

Mass PRIM tapped Michael McGirr to succeed Michael Bailey as private equity director

The operations divested from the Japanese business include Shiseido’s well-known drugstore brands, such as Tsubaki hair care products and Senka face wash

The UK’s National Security and Investment Bill could create delays and greater uncertainty if passed

Volumes in Asia’s loan market have slumped in recent years, with the pandemic only adding to the pressure. But the biggest challenges for both banks and borrowers are just starting to emerge — and will

Indonesia’s Adaro Energy has sent out a request for proposals for a $400m loan to meet its refinancing needs.

JP Morgan’s head of southeast Asia equity capital markets has resigned, according to a source familiar with the matter.

Redhawk Wealth Advisors, Inc., a national full-service registered investment advisor, is pleased to announce an advisor team from Merrill Lynch, that manages $150 million in assets under management,...(PRWeb February 03, 2021)Read the full story at

Recent Comments