Tsinghua Unigroup bonds plunge to new low

Dollar and renminbi denominated bonds of cash-strapped Chinese issuer Tsinghua Unigroup Co were heavily sold off this week, following renewed concerns over the company’s debt repayment ability.

Dollar and renminbi denominated bonds of cash-strapped Chinese issuer Tsinghua Unigroup Co were heavily sold off this week, following renewed concerns over the company’s debt repayment ability.

Ascendas Real Estate Investment Trust has tapped the equity market for S$1.19bn ($887.7m) to finance a global purchasing spree.

The Government's adjustment to aid for businesses is a welcome step for private equity firms, but it may be a false dawn

Singapore-based FKS Food & Agriculture has closed a $255m-equivalent dual currency deal with eight lenders.

Redco Properties Group has tackled some of its upcoming maturities by selling a new $266m bond to refinance debt.

Wind power giant China Longyuan Power Group Corp found overwhelming support for its $300m bond sale, with investors giving the firm’s state ownership, deal timing and sector of operation a big thumbs up.

Third-party risk management solution developer Venminder has scored $33m in its Series C round, which was led by Silversmith Capital Partners.

Isovalent, a cloud-native networking company, has launched its services to help enterprises connect, observe and secure modern applications with its Cilium product.

ARA Asset Management and property company Chelsfield have raised a S$385.8m ($286m) green loan to finance the acquisition and renovation of 5One Central, a commercial building in Singapore.

SINGAPORE--(BUSINESS WIRE)-- Global investment firm KKR today announced the appointment of Jim Rowan, former Chief Executive Officer of Dyson Ltd., as a Senior Advisor to KKR’s Asia Private Equity team. Mr. Rowan brings more than

Posted by Sarath Sanga (Northwestern University) and Eric L. Talley (Columbia University), on Tuesday, November 10, 2020 Editor's Note: Sarath Sanga is Associate Professor at Northwestern University Pritzker School of Law, and at Kellogg School

Companies would have to report on the financial impacts of climate change on their businesses within the next five years

CEE-based private equity firm Innova Capital will acquire an undisclosed stake in Polish cosmetics brand Bielenda Kosmetyki alongside its management.

Bridgepoint has acquired a minority stake in Swedish skin clinic operator Diagnostiskt Centrum Hud (DCH) alongside its management.

Technology-focused corporate finance firm Clipperton has hired Nikolas Westphal as a partner in its Berlin-based team.

Video gaming-focused venture capital house Griffin Gaming Partners has raised $235m to invest across the already titanic industry.

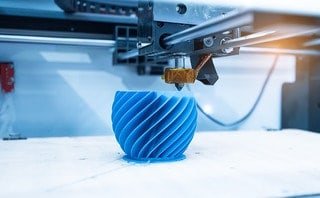

High-Tech Gründerfonds (HTGF), Bayern Kapital and Deutsche Balaton have led a €2m round for All3DP, a 3D printing internet platform.

Lea Partners has sold financial performance management software IDL to US-based Insightsoftware, a portfolio company of TA Associates and Genstar Capital.

Recent Comments