Cerberus Capital Management said to eye $3bn for latest flagship distressed buyout, debt fundraise

Distressed investment specialist Cerberus Capital Management is reportedly eyeing up to $3bn for its latest flagship fundraise.

Distressed investment specialist Cerberus Capital Management is reportedly eyeing up to $3bn for its latest flagship fundraise.

Credit and distressed specialist Värde Partners has held a final close for its Värde Dislocation Fund on $1.6bn, exceeding its $1bn target after five months on the road.

European lottery operator Sazka Group has picked up a €500m investment from private equity giant Apollo Global to value the business at about €4.2bn.

SoftBank Vision Fund has led a $250m funding round for Germany-based e-scooter startup Tier Mobility.

TA Associates has brought in Advent International fundraising exec Andrew Harris as its new global investor relations head.

EQT has agreed to sell Danish portfolio company Tia Technoloy to the listed software company Sapiens.

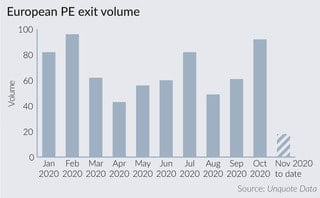

Following another period of lacklustre exit activity in Q3, even as deployment was picking up, October saw a notable spike in divestments by PE players across Europe.

Opalesque Industry Update - Northern Trust today announced the launch of its next-generation investor portal for alternative asset managers, offering an enhanced investor experience with updated data feeds, customized views and analysis. Increasingly, investors seek

Opalesque Industry Update - The Eurekahedge Hedge Fund Index was down 0.16% in October 2020, outperforming the global equity market as represented by the MSCI ACWI (Local), which lost 2.29% over the same period. Global

Paris-based private equity and infrastructure investor Omnes has made its first Irish renewables deal by backing solar PV developer Power Capital Renewable Energy.

Lower mid-market private equity specialist The Riverside Company has brought in former AlpInvest North America head Iain Leigh in the wake of his retirement from APG Asset Management.

LDC has sold communications technology firm Babble to Graphite Capital for an enterprise value of £90m.

Mid-market Chicago buyout house CIVC Partners has celebrated its 50th year in of investing by sealing a hard cap-beating $525m final close for its sixth flagship fundraise.

Credit and distressed investment specialist Värde Partners has hauled in a target-busting $1.6bn for a new Covid-19 dislocation fund, just a year after raising its biggest-ever flagship buyout fund.

Silver Lake spinout Sumeru Equity Partners has soared past its Fund III goal to haul in $720m for a final close of the investment vehicle.

The company said it anticipates an increased need by UK companies for fresh equity, and that a proactive public and private equity investment strategy can generate positive returns

Banks in the City say that only critical staff are required to come into the office

Despite charging more for their expertise, studies have shown that active funds have failed to beat index-trackers

Finance directors working for a mid-market private equity-backed business now earn an average salary of £166,368, down from £173,381 in 2019

Recent Comments