EQT to launch Huscompagniet’s IPO – report

Swedish private equity firm EQT is launching an IPO for its portfolio company Huscompagniet, a Danish residential construction business, according to press reports.

Swedish private equity firm EQT is launching an IPO for its portfolio company Huscompagniet, a Danish residential construction business, according to press reports.

Tencent has acquired a minority interest in Goldman Sachs-backed Voodoo, a gaming company.

Syntegon Technology, a portfolio company of CVC Capital Partners, has sold its Viersen-based operations to Rotzinger, a Switzerland-based company that produces conveyor and storage systems used in the packaging industry.

Insurance company Ardonagh Group, a portfolio company of US private equity houses HPS Investment Partners and Madison Dearborn Partners, has acquired Thames Underwriting.

Spanish venture capital house Bullnet Capital has sold version control software (VCS) specialist Codice SW to Unity Technologies, a private-equity-backed US software company.

Building facilities service Konzmann, a portfolio company of Adiuva Capital, has acquired Germany-based heating, ventilation and refrigeration systems specialist Trenker.

Growth equity specialist McCarthy Capital has easily beaten the target for its seventh flagship fundraise through a $525m final close.

Ukrainian private equity firm Horizon Capital has led a $5m funding round for Liki24, a Kyiv-based e-commerce platform for medicine delivery.

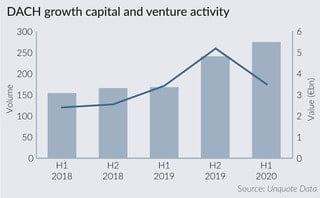

Growth and venture capital deal volume exceeded that of all previous half-yearly figures in the DACH region in H1 2020, making for a busy first half of the year that saw 275 such deals, according

Digital Finance Forum's annual survey of fintech founders finds they think the government should do more to support the sector

Nordic Capital has shrugged off the potential dangers of launching a flagship fundraise amid the coronavirus pandemic by beating its €5bn target through a first close, it has been reported.

Notion Capital has led a €7m series-A funding round for insurance technology company Claimsforce.

Venture capital performance remained 'unscathed' in the first quarter of 2020 despite the onset of the coronavirus pandemic, as the industry consolidated what had been an exceptional 2019, new research shows.

Bain Capital has beaten back last-minute competition from Baring Private Equity Asia to seal a $1.2bn buyout of Japanese nursing home operator Nichiigakkan.

Initialized Capital, the investment firm launched by Reddit co-founder Alexis Ohanian and ex-Y Combinator partner Garry Tan, has hauled in $230m for its fifth seed fund.

Keeper Security, a cybersecurity platform aimed at preventing password-related data breaches and cyberthreats, has picked up a $60m minority investment from Insight Partners.

Boston-based buyout house Berkshire Partners is back in the market for what could be its biggest-ever fundraise, with a reported target of $6.5bn.

GEF Capital Partners has bought a controlling interest in municipal and industrial water and waste water specialist EnviroMix.

Nine in 10 UK leaders surveyed by PwC offered wellbeing initiatives to employees

Group led by Catalyst Capital close to winning control of the troubled performance group

Recent Comments