ESM reform hangs in the balance ahead of Italian vote

Italian MPs are threatening to use a vote in parliament this week to derail a recent EU agreement on planned reforms for the European Stability Mechanism (ESM).

Italian MPs are threatening to use a vote in parliament this week to derail a recent EU agreement on planned reforms for the European Stability Mechanism (ESM).

Sovereign and corporate debt has rocketed during the coronavirus pandemic, as liquidity became the essential plaster to cover the almost overnight collapse in consumer spending. European treasurers might be tempted to spend 2021 shying away

MiddleGround Capital has acquired majority ownership of Dura Automotive Systems from Bardin Hill Investment Partners. The buy of Dura is MiddleGround’s sixth platform acquisition in its first fund which closed in August 2019. Dura Automotive

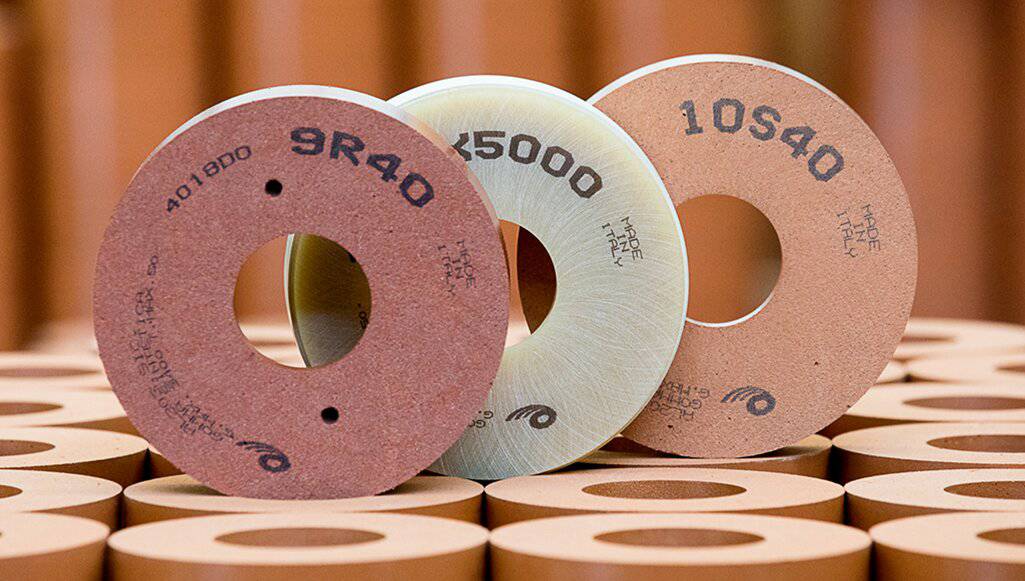

Astorg has agreed to sell its portfolio company Surfaces Group to TA Associates. Surfaces Group is a supplier of abrasive tools and consumables used in the manufacturing process of high-end materials. The group’s products are

Noble Foods Nutrition, a contract manufacturer of nutrition and energy bars and a portfolio company of Novacap, has acquired the co-packing activities of Betty Lou’s, an energy bar manufacturer. Betty Lou’s, under its own brand

Emerging market bond mandates are continuing into the last month of the year, despite expectations that activity would quieten down after a jam-packed year of issuance. Kuwait’s Burgan Bank and Montenegro are among some of

Saxony elected to bring a 15 year benchmark to market on Tuesday, launching the deal in an otherwise deserted primary market. The negative yield told against the deal, which was sold without being fully subscribed.

The deal includes the payment of an upfront consideration of $425m for the company, which is developing a compound to alleviate menopausal symptoms

Amid a wider overall slump in mergers and acquisitions, the sale of noncore units is a bright spot, say bankers

Chinese property developer Yanlord Land Group has increased the size of its latest borrowing to $1.1bn-equivalent after receiving strong response during syndication.

Moody’s Corp has acquired a minority stake in credit rating agency Malaysian Rating Corp (MARC), giving the US firm additional access to Malaysia’s domestic bond and sukuk markets.

Chinese property developer Fantasia Holdings Group Co reopened a bond initially sold three years ago in a bid to lower its funding costs, taking $200m from the tap.

Vistas Media Acquisition Co (VMAC) has raised $100m after listing on the Nasdaq. It plans to use the funds for an M&A in the media and entertainment industry.

Hangzhou Qiantang New Area Construction and Investment Group Co, a Chinese local government financing vehicle (LGFV), found strong support from banks for its maiden dollar bond, allowing it to tighten price guidance by 70bp during

Redco Properties Group returned to the dollar market with a sub-one year bond on Tuesday, two weeks after using up its offshore issuance quota.

Hong Kong-based Li & Fung used a coupon step-up in case of a rating downgrade to attract investors to its $300m bond on Tuesday, as it gears up for a big hit to its business

Private equity firms are bingeing on junk bonds as central bank moves have supported high-yield debt markets

Occident has led a CHF 5.1m round for therapeutic blood purification technology developer Hemotune, with participation from South Korea-based Greencross Medical Science Corp (GCMS) and the Zürcher Kantonalbank.

Dublin-headquartered startup Antikytera E-Technologies has received an investment from a venture capital house to further expand its remote assistance software and artificial intelligence technology.

Germany-based venture capital investors EVentures, 468 Capital and HV Holtzbrinck Ventures have backed a €5m seed round for Klima, an app that allows users to make donations to mitigate their carbon footprint.

Recent Comments