Hony Capital’s PizzaExpress to cut 1,100 jobs as it agrees to restructuring deal

The restaurant chain, which has been struggling since the pandemic hit, is putting itself up for sale and is looking to close some 67 restaurants in the UK

The restaurant chain, which has been struggling since the pandemic hit, is putting itself up for sale and is looking to close some 67 restaurants in the UK

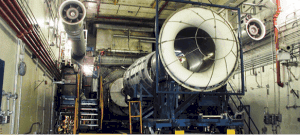

After just over a five-year hold, Gen Cap America has sold Aero Systems Engineering to Calspan Technology. Aero Systems Engineering (ASE) designs, builds and upgrades jet engine testing and wind tunnel facilities, and provides lab

Publicly traded Triumph Group has agreed to sell its aerospace composites operations to Arlington Capital Partners. The Triumph composites operations (TCO) – with locations in Milledgeville, Georgia (650,000 sq. ft.) and Rayong, Thailand (135,000 sq.

MSD Partners has held a final closing of MSD Special Investments Fund LP with $825 million in capital. The new fund had a target of $500 million. MSD Partners was formed in 2009 by the

Ocean Avenue Capital Partners has closed Ocean Avenue Fund IV LP at its hard cap of $350 million. The new fund had an original target of $300 million. Investors in Fund IV include public and

Callista Private Equity has acquired lighting company Ledvance’s Eichstätt-based operations via the holding company Aurora Lichtwerke.

Canadian private equity firm Paradigm Capital has increased its shareholding in listed Swedish listed education company Internationella Engelska Skolan (IES).

Opalesque Industry Update - Prime Capital AG, the independent asset manager and financial services provider that manages amp;euro;17.2bn across multiple funds, is launching the Liquid Alternative Credit Fund, a new fund of funds, beginning of

US-headquartered private equity firm Ripplewood Advisors has entered exclusive negotiations to acquire Germany-based digital banking platform Fidor Bank, according to a statement from Fidor’s parent company, French bank BPCE.

Ocean Avenue Capital Partners has beaten its goal for its fourth flagship fundraise by hauling in $350m for a hard cap final close.

Peninsular Capital has backed the MBO of NovaSparks, a French provider of ultra-low latency trading systems for the financial trading industry.

DN Capital, Kreos Capital, Redalpine, Speedinvest, Founders Future, Enern, Digital Horizons and Cometa have invested €11m in fintech startup Bnext.

Pentapart Beteiligungskapital has acquired Germany-based signage company Westiform after the business filed for administration in October 2019.

Growth Capital Partners (GCP) has invested in materials manufacturer GTS Flexible Materials.

Magnum Capital has acquired Spain-based online business school Instituto superior para el desarrollo de internet (Isdi).

Private equity firm Siparex has acquired a minority stake in France-based actuarial consulting firm Fixage.

The deal will support the expansion of the British company's offering and customer base, both organically and through acquisitions

The group said it is in talks with Centerbridge Partners Europe and TowerBrook Capital Partners; Platinum Equity Advisors; and Warburg Pincus International

US-based private equity firm Acon Investments has acquired a majority stake in Sola de Antequera (Alsur), a Spanish producer and distributor of preserved and canned vegetables.

Hg has secured a majority stake in portfolio company Evaluate following an additional investment in the pharmaceuticals analytics business.

Recent Comments