Abraaj liquidators sue fund backed by Gates Foundation

Liquidators of the bankrupt private equity firm are suing to reclaim $109m transferred to its healthcare fund before the firm went under

Liquidators of the bankrupt private equity firm are suing to reclaim $109m transferred to its healthcare fund before the firm went under

Guardian Capital Partners has picked up $282m for the hard cap final close of its third flagship fundraise, six years after closing its predecessor vehicle.

David Forbes, who worked at a firm running the fund and was close to the bank’s 2008 bailout, told the court that he was concerned

Private equity real estate specialist Castleforge Partners has hauled in more than £270m for the final close of its third flagship fundraise.

Brookfield Asset Management has hit an initial €725m close for its first European core-plus real estate fund as it looks to take advantage of volatility in the current market.

Peak Rock Capital has exited its three-year investment in water treatment products provider Hasa through a sale to GHK Capital Partners.

Laxman Pai, Opalesque Asia: European private equity (PE) deal volume plunged to its lowest point in seven years during the second quarter, with the UK suffering the greatest drop. According to PitchBook, deal count and

Laxman Pai, Opalesque Asia: Globally, deal activity rebounded in Q2&`20 to 3,812 deals while funding decreased to $50.2b. Funding and deals are down 13% and 9% YoY, respectively, said a report. Asia saw the largest

The Stephens Group is continuing the build of Catalyst Acoustics Group with the buy of Fräsch, the company’s fifth add-on acquisition. Fräsch is maker of polyester wall panels, ceiling treatments, baffles, dividers, partitions, and acoustic

Brookfield Asset Management has closed a US$260 million preferred stock equity investment in Superior Plus. Toronto-headquartered Superior (TSX: SPB) provides delivery, wholesale procurement and retail marketing of propane-related products, and distributes fuels including heating oil

Private equity firms spend millions of dollars each year on legal services and increasingly are taking a closer look at this expense category according to a new study by Apperio entitled “Rocketing Scrutiny, Eroding Trust

Tonka Bay Equity has hired Zach Huston as an investment associate. In his new role, Mr. Huston will be actively supporting the investment activities of the firm. Before coming over to Tonka Bay, Mr. Huston

Institutional investors are avoiding traditional energy-focused funds due to low oil prices, poor returns and increasing concerns on the environment

Majority of in-house counsel at buyout firms complain their legal bills are not transparent, a survey by legal tech provider Apperio has found

Swedish private equity firm EQT plans to close EQT IX, which has a €14.75bn target and €15bn hard-cap, during the third quarter.

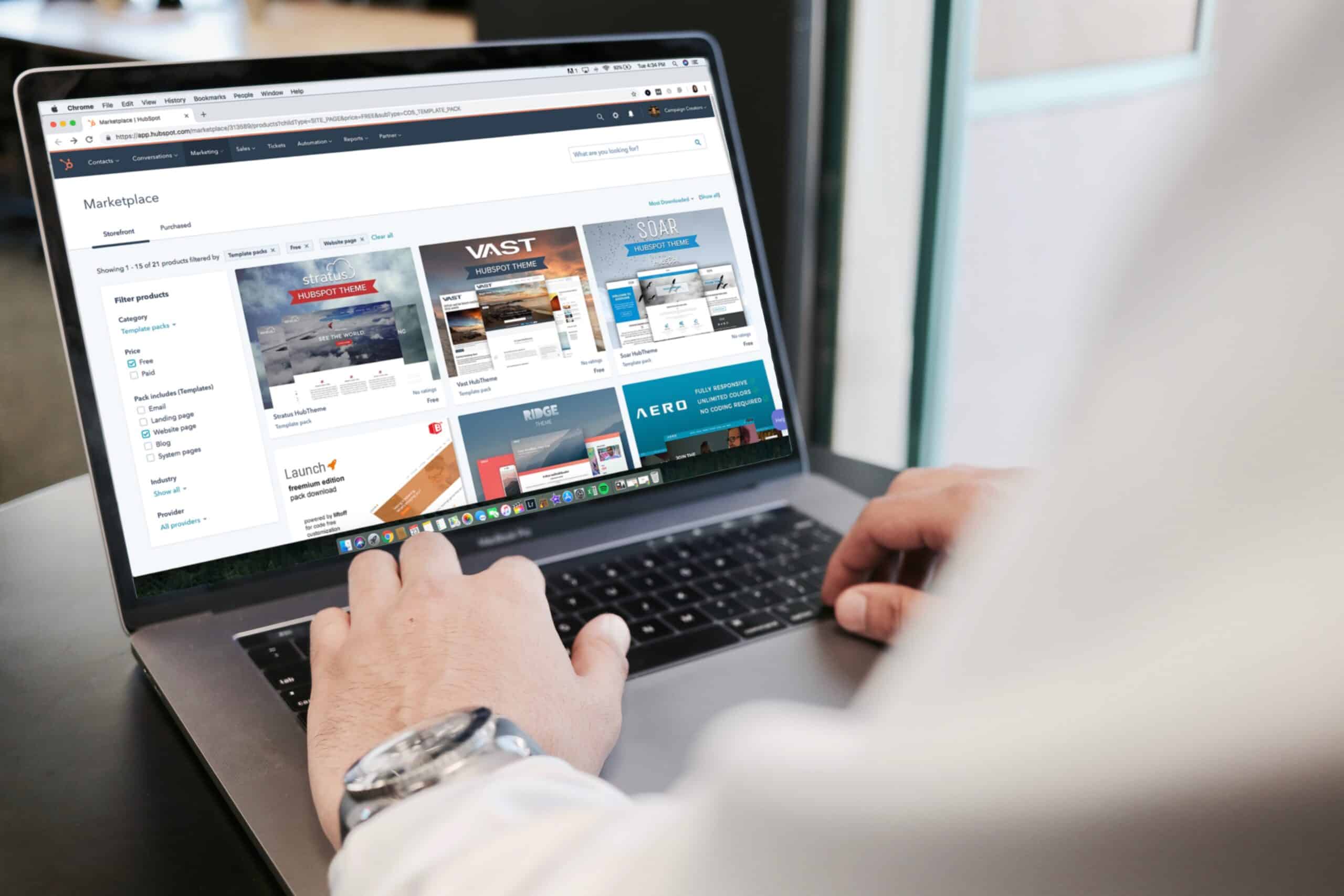

Fintech startup Titanbay is hoping to open up private equity investing to small and medium-sized institutional and private investors through its newly-launched platform.

Committed Capital has acquired a majority stake in Netherlands-based Intersteel, a manufacturer of door handles from private equity firm 5Square and shareholder Peter van Leeuwen.

Private equity firm UI Gestion, alongside Caisse d'Epargne Ile-de-France Capital Investissement (CEIDF) and IRD Gestion, has acquired French packaging specialist Sopac Medical from Turenne Sante and A Plus Finance.

LP platform Titanbay has now launched its platform for smaller LPs to invest in private equity funds.

Recent Comments