OwnBackup Secures $50 Million in Funding to Help Protect Critical SaaS Data

Laxman Pai, Opalesque Asia: The global real estate investment manager, Patrizia AG announced the final close of its seventh flagship trans-European real estate fund, Trans-European VII LP (TEP VII), at its hard cap, wi...Article Link

Laxman Pai, Opalesque Asia: Lyxor Peer Groups suggest hedge fund performance was up +0.6% in June, with CTAs underperforming (-1%) and Directional L/S Equity, L/S Credit and Special Situation strategies outperforming (+1...Article Link

CVC started raising its eighth fund in January

CVC Capital Partners has closed its eighth buyout mega-fund on €21.3bn, Unquote understands.

Switzerland-based freight and logistics company Schneider Group, a portfolio company of Invision, is to acquire an 80% stake in Apriori Transport & Logistics, according to a filing with the German competition authority.

Berglandklinik Lüdenscheid, a subsidiary of Triton portfolio company Meine Radiologie Holding, has acquired three Germany-based gynaecology clinics.

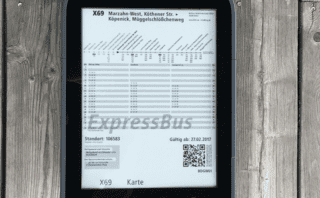

Adelis Equity Partners has acquired a majority stake in Axentia Technologies, a Swedish provider of displays for public transport.

Venture capital house B Capital Group has held a final close for its second fund on $820m.

New York buyout house Lindsay Goldberg has passed the $3.3bn mark for its fifth flagship fundraise, putting it close to its $4bn goal.

AP Moller - Maersk has entered into an agreement to wholly acquire KGH Customs Services, a provider of trade and customs management in Europe, from Bridgepoint Development Capital (BDC) and other shareholders for SEK 2.6bn ($279m).

CymbiQ Group, a portfolio company of Capiton, has acquired Zurich-based IT security and data business Aspectra.

Antares has launched a restructuring fund with a €300m target to support the recovery of Italian companies operating in the fashion industry hit by the coronavirus emergency.

TnuiCapital has agreed to acquire restaurant chain Busaba Eathai.

Munich-headquartered fund-of-funds manager Golding Capital Partners has held a first close on almost €200m for its private debt fund Golding Private Debt 2020.

Singapore-based asset manager Indies Capital Partners has hit a $100m first close for its third private equity and structured credit fundraise.

Spanish impact fund Fondo Bolsa Social has held a €10m first close and expects to raise total commitments of €25m.

Recent Comments