Lifeline in €6.2m round for Tilt Biotherapeutics

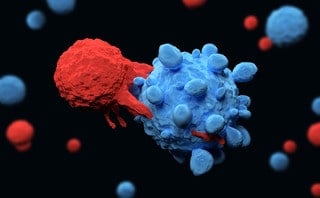

Helsinki-based clinical-stage cancer immunotherapy developer Tilt Biotherapeutics has secured an additional €6.2m in funding from Lifeline Ventures and other private investors.

Helsinki-based clinical-stage cancer immunotherapy developer Tilt Biotherapeutics has secured an additional €6.2m in funding from Lifeline Ventures and other private investors.

Opalesque Industry Update - The Geneva based asset management firm Notz Stucki strengthens its institutional sales team with three new hires in Geneva, Zurich and Milan. Alexis Peytre beefs up the Geneva team, Pascal Scherer

Opalesque Industry Update - The global hedge fund business posted an average +2.54% return for May, according to the latest eVestment hedge fund performance data. The rebound last month wasn 't enough to turn the

Opalesque Industry Update - As financial markets continued their recovery and economies began to reopen from COVID-19 pandemic shutdowns, managed futures were able to capture a small profit in May, gaining 0.04% according to the

Corten Capital has closed its debut fund on €392m.

Deutsches Werkstattnetz has wholly acquired online car repair booking platform Caroobi, from its venture capital backers.

Newly established venture capital house Meta Change Capital (MCC) has launched its debut fund with a €100m target.

Nordic private equity firm CapMan has launched CapMan Special Situations to focus on turnarounds.

It seems like World Gym could soon have another stakeholder soon as reports are surfacing that private equity firm CDIB Capital International is eyeing a slice of the company. Having spoken with people with knowledge

Parabellum Capital has held the $465m final close for its sophomore private investment fund.

Accelya, a Spanish airline financial analytics specialist backed by Vista Equity Partners, has acquired Farelogix, a Miami-based software-as-a-service provider for the airline industry.

Venture capital investors have participated in a £60m funding round for online bank Monzo, giving it a valuation of £1.24bn.

Corten Capital's fund has exceeded its target at a time when raising capital for firms' first vehicles has become more difficult

Specialist investment firm Corten Capital has held the €392m final close for its maiden fund, which will back technology-driven B2B services.

New research suggests that the coronavirus could have impacted private equity firms desire to close buyout fundraising deals. Having looked at data from its own platform covering the first three months of 2020, CEPRES revealed

Private equity firm Marcury Capital has acquired massive magazine publisher Bauer Media Australia in a deal reportedly being for “less than $50m”. The comments about the size of the deal were made in the Australian

Enstar Group has announced that it has agreed to a recapitalisation of StarStone U.S. led by SkyKnight Capital, Dragoneer Investment Group and Aquiline Capital Partners. Together, the investors have committed $610m in new equity capital

Enstar Group has announced that it has agreed to a recapitalisation of StarStone U.S. led by SkyKnight Capital, Dragoneer Investment Group and Aquiline Capital Partners. Together, the investors have committed $610m in new equity capital

GreyLion Capital has finalised its spinout from Perella Weinberg Partners Capital Management, becoming an independent, employee-owned investment firm.

With a deadline extension ruled out, both parties must be prepared to compromise

Recent Comments