McWin closes EUR 500m restaurant fund backed by ADIA

Food specialist sponsor McWin Partners has closed a EUR 500m dedicated restaurant fund with the backing of a subsidiary of the Abu Dhabi Investment Authority (ADIA).

Food specialist sponsor McWin Partners has closed a EUR 500m dedicated restaurant fund with the backing of a subsidiary of the Abu Dhabi Investment Authority (ADIA).

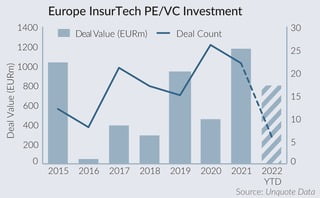

Insurtechs have long been overlooked by investors as fintechs’ smaller and less-attractive sidekicks. But now, as private equity firms search for rising stars, it seems some scaleups are finally getting to star in their own

Cinven is set to exit Luxembourg-based Tractel via a sale to industrial equipment supplier Alimak Group that values the working-at-height specialist at EUR 500m.

KKR has agreed to sell Minnesota Rubber and Plastics to Trelleborg Group at $950m enterprise value. The post KKR nods to $950m deal for Minnesota Rubber and Plastics exit first appeared on AltAssets Private Equity

NEW YORK--(BUSINESS WIRE)-- KKR & Co. Inc. (NYSE: KKR) today reported its second quarter 2022 results, which have been posted to the Investor Center section of KKR’s website at https://ir.kkr.com/events-presentations/. This press release features multimedia.

Mid-market sponsor LDC has sold Aqualisa to US-listed Fortune Brands Home & Security in a transaction that values the UK-based manufacturer of shower products at GBP 130m.

Gilde Equity Management has sold its majority stake in Dutch healthcare software developer Avinty to Main Capital Partners.

The Philadelphia Public Employees Retirement System will commit $50m to Vista Capital Solutions and $25m to its co-investment vehicle. The post The Philadelphia Public Employees Retirement System picks Vista for latest PE commitment first appeared

Private equity major Cinven has agreed to exit working-at-height devices maker Tractel for €500m enterprise value. The post Cinven to exit working-at-height devices maker Tractel after seven-year hold first appeared on AltAssets Private Equity News.

The board of Ontario Teachers’ Pension Plan has agreed to exit funeral services company Mémora Group to Spanish insurance company Grupo Catalana Occidente for a €600m enterprise value. The post OTPP to exit funeral service provider

Intermediate Capital Group has almost doubled its predecessor to close its eighth European Corporate fund on €8.1bn. The post ICG almost doubles Europe VII to close €8.1bn fund VIII first appeared on AltAssets Private Equity

Warburg Pincus has exited credit market data, intelligence and analytics provider Reorg to fellow private equity major Permira. The post Warburg Pincus to sell credit market date, analytics specialist Reorg to private equity peer Permira first

Multi-strategy private equity house Banner Ridge Partners has hit a $639m hard cap close for its second vehicle targeting distressed, special situations and credit fund, co-invest and early secondaries opportunities. The post Siguler Guff spin-out

UK-based Octopus Ventures has launched its first dedicated pre-seed fundraise targeting early-stage startups across Europe. The post Octopus Ventures strikes first close for first dedicated pre-seed fundraise first appeared on AltAssets Private Equity News.

Assured Healthcare Partners, the specialist investor backed by Carlyle arm AlpInvest, has struck a $750m-plus fund close. The post AlpInvest-backed healthcare investor Assured hits $750m fund close first appeared on AltAssets Private Equity News.

Permira and minority shareholders including The Ganivenq Family and Batipart are set to exit Vacanceselect, a campsite and mobile-home operator, in a sale to PAI-backed European Camping Group (ECG).

Distressed investor Aurelius is to acquire UK streetwear and sportswear retailer Footasylum from JD Sports in a deal valued at around EUR 45m.

Private equity firm Montagu entered into exclusive negotiations to sell French health supplement maker Arkopharma to branded drug manufacturer Dermapharm for EUR 450m.

Germany-headquartered SwanCap Partners is expecting to hold a first close for SwanCap Co-investment Opportunities VI in October 2022, founder and co-CEO Florian Kreitmeier told Unquote.

Recent Comments