Equistone weighs auction for United Initiators

Equistone is weighing a sale of specialty chemicals supplier United Initiators, three sources familiar with the matter said.

Equistone is weighing a sale of specialty chemicals supplier United Initiators, three sources familiar with the matter said.

Danish small-to-mid cap investor Erhvervsinvest is aiming for a final close of its fifth private equity fund in the next nine to 12 months, Managing Partner Thomas Marstrand said.

Novum Capital has put MMC Studios, a German film and television production company, into a continuation fund after initially exploring a sale, according to two sources familiar with the situation.

Eurazeo has closed the sale of its majority stake in Orolia to aircraft parts manufacturer Safran in a deal that generated cash proceeds of EUR 189m.

Finnish private equity firm CapMan Buyout has exited local industrial group Fortaco to One Equity Partners while also acquiring cybersecurity group Netox.

Submit your entry for the 2022 Unquote British Private Equity Awards before 15 July 2022 at 5pm

Perwyn, a UK-based family-backed private and growth equity investor, has appointed James Gavey as its new CFO.

Estonian venture capital firm Superangel is aiming for a hard cap of up to EUR 50m for its second fund following its announcement last month, general partner Marko Oolo told Unquote.

Paris-based sponsor Apax Partners is getting ready to launch its second small-cap private equity fund due to hit the market for fundraising before the end of the year.

Consumer and technology investor Mayfair Equity Partners has agreed to fully exit portfolio company Talon Outdoor to Equistone; the company’s management will retain a meaningful stake.

US buyout house Carlyle is in the final stretch of talks to acquire Italian irrigation systems producer Ocmis, sources said.

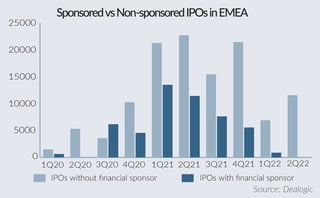

Despite a wave of IPO postponements in 2022, corporate sellers are adjusting to new valuation benchmarks and will be the most likely to pursue IPOs for their assets this year.

Dutch venture capital firm Curiosity VC is aiming to hold a final close for its debut fund on a hard cap of up to EUR 75m next year, Managing Partner Herman Kienhuis told Unquote.

Investec has promoted Kate Gribbon to head the investment bank’s financial sponsor coverage for private equity, growth equity and venture capital.

Levine Leichtman Capital Partners is to seal its first German deal in the upcoming 12 months as it looks to cement its place in the DACH market, the GP’s new European head, Josh Kaufman, said.

Switzerland-based asset manager Unigestion has held a EUR 900m final close for Unigestion Secondary V (USEC V), surpassing its EUR 700m target.

Private equity firm Inflexion has acquired Irish contract manufacturing organisation (CMO) SteriPack.

IRIS Software majority owner Hg has appointed Goldman Sachs and Arma Partners to advise on an upcoming sale of the business, two sources familiar with the situation said.

August Equity has sold Amtivo, a provider of accredited certification to companies across 23 countries, to Charterhouse Capital Partners.

French mid-market private equity firm Adagia Partners has entered into exclusive negotiations to acquire dental prosthetics producer Minlay from Motion Equity Partners.

Recent Comments