Montagu acquires Capita's ESS, invests in ParentPay

Montagu Private Equity has agreed to acquire Capita Education Software Solutions (Capita ESS) from parent company Capita, and will invest in education technology provider ParentPay.

Montagu Private Equity has agreed to acquire Capita Education Software Solutions (Capita ESS) from parent company Capita, and will invest in education technology provider ParentPay.

Europe's Montagu Private Equity has agreed to acquire the Education Software Solutions business of Capita plc alongside an investment in ParentPay Group.

Montagu will also invest in ParentPay, a provider of education technology, which will be combined with Education Software Solutions

WestBridge has acquired business management software developer Eque2 from LDC for £46.5m.

Opalesque Industry Update, for New Managers - Distressed debt and special situations specialists Arbitrium Capital Partners has hired Blake Ammit as Managing Director and Ian Lundy as an independent member of the Investment Committee. Launched

BNP Paribas Asset Management is targeting up to €1bn of new investment capital through the launch of two infrastructure debt fundraises.

The deal values Pluralsight at $20.26 a share, or $3.5bn including debt, the companies said

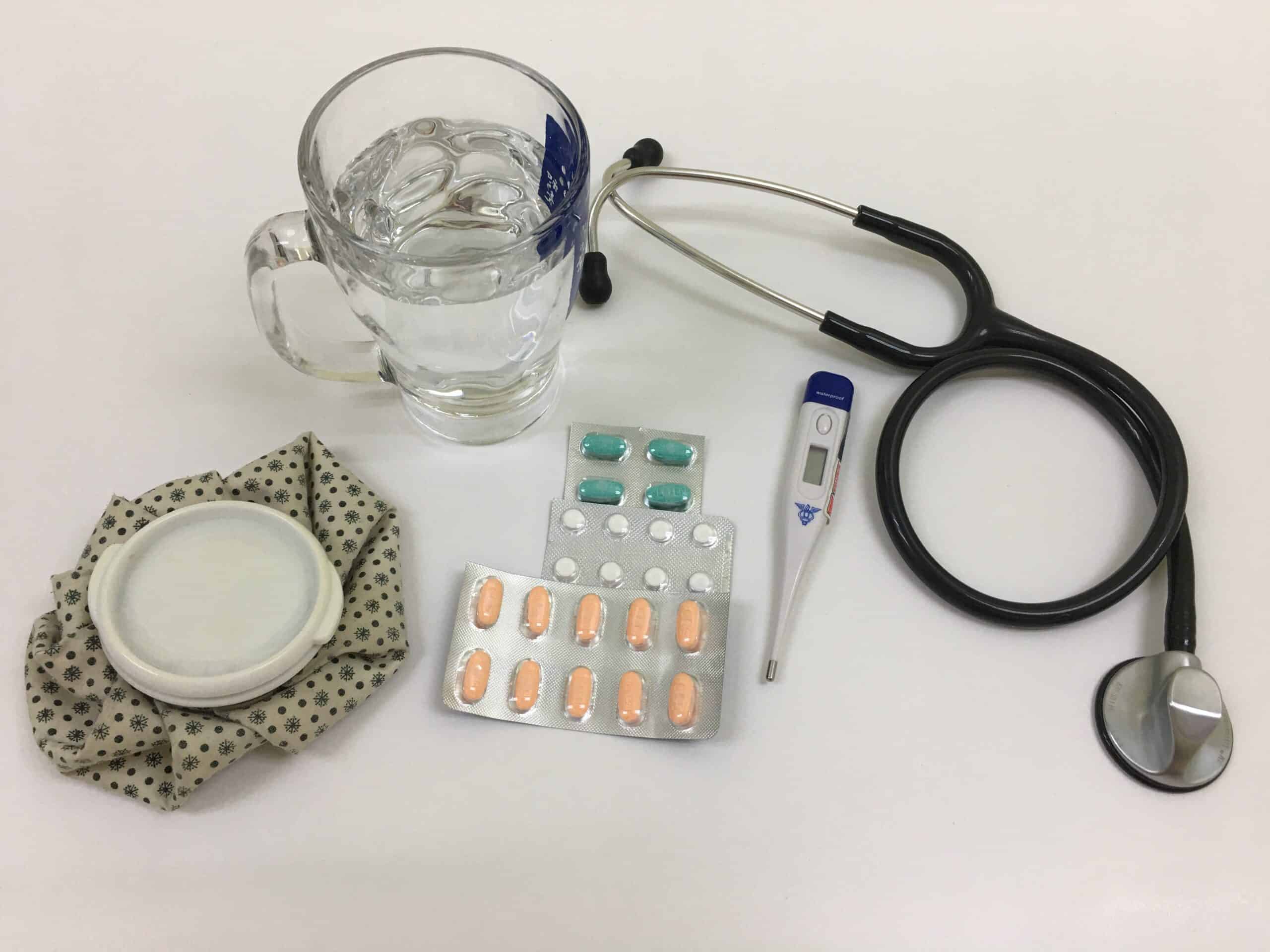

French investment giant Eurazeo has been picked to manage a new €420m healthcare fund launched by the French Insurance Federation and the Caisse des Dépôts.

New York Life Investment Management’s PE unit, GoldPoint Partners, has hauled in more than $550m towards its fifth private debt fund.

Firms are more closely looking at climate-related risks in their portfolios and investments

Laxman Pai, Opalesque Asia: PricewaterhouseCoopers (PwC) expects more megadeals - transactions of at least $5 billion in value - in 2021, from pharma companies acquiring early-phase or pre-commercial products in hot ther...Article Link

Acquisition Expands KKR’s Industrial Real Estate Footprint to 30 Million Square Feet NEW YORK--(BUSINESS WIRE)-- KKR, a leading global investment firm, today announced the acquisition of a portfolio of approximately 9.7 million square feet of

MB Funds has entered into an agreement to sell Finnish portfolio company Kotkamills to listed Austrian cardboard packaging group Mayr-Melnhof (MMK) for an enterprise value of around €425m.

Rockpool Investments has provided growth capital to Xiatech, a system integration and data analytics software provider.

Octopus Ventures and BGF have invested in a $24m funding round for space launch system developer Orbex.

Insurance and investment management giant Prudential Financial has launched a $300m venture capital fund, its first through subsidiary PruVen Capital.

'It illustrates the uncertainty in the market as to what Brexit actually means, [and] what the future relationship will be,' said Andrew Pilgrim, EY's UK government and financial services leader

'It illustrates the uncertainty in the market as to what Brexit actually means, [and] what the future relationship will be,' said Andrew Pilgrim, EY's UK government and financial services leader

Recent Comments