Quadriga-backed Scio buys Bilfinger GreyLogix Aqua

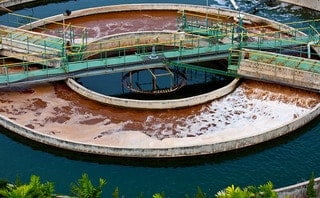

Scio Automation, a portfolio company of Quadriga Capital, has acquired Germany-based Bilfinger GreyLogix Aqua, a subsidiary of Bilfinger GreyLogix.

Scio Automation, a portfolio company of Quadriga Capital, has acquired Germany-based Bilfinger GreyLogix Aqua, a subsidiary of Bilfinger GreyLogix.

Schroders Group impact investor BlueOrchard Finance has launched a $350m-targeting fund looking to support frontier market small and micro-businesses struggling amid the coronavirus pandemic.

PAI Partners has tapped its new specialist mid-market fund to pick up a majority stake in Spanish fish-based ready meals business Angulas Aguinaga from fellow private equity house Portobello Capital.

Private equity firm The Riverside Company has entered into an agreement to sell its portfolio company Swedish Education Group, an operator of compulsory and vocational schools, to listed education company AcadeMedia for SEK 185m (€17.8m).

Apse Capital has acquired TerraQuest Solutions, a developer of land, planning and data technology software, for a maximum valuation of £72m.

Apiary Capital has backed the launch of independent financial advisory buy-and-build business Radiant Financial Group through a capital investment.

Recruitment firm Finatal has launched Finatal Private Equity, a new division focusing on providing talent for private equity funds.

The BoE’s Monetary Policy Committee unanimously backed the stimulus hike

In the week ending November 6th 2020, Peter Zhou, a former senior managing director at Coatue, has been launching his own new fund with at least $300 million in commitments already, sources say. China&`s Hony

In the week ending November 6th 2020, Peter Zhou, a former senior managing director at Coatue, has been launching his own new fund with at least $300 million in commitments already, sources say. China's Hony

Opalesque Industry Update - Hedge funds posted performance gains in October 2020, navigating a hectic month of campaigning heading into the U.S. election, which was also punctuated by a sharp increase in coronavirus cases in

In the week ending November 6th 2020, Peter Zhou, a former senior managing director at Coatue, has been launching his own new fund with at least $300 million in commitments already, sources say. Chinaamp;amp;'s Hony

French private equity firm Andera Partners has reinvested in French HR software developer Octime in a minority LBO transaction through its Cabestan fund.

European software-focused private equity investor Hg has agreed the sale of Eucon Group to German insurer VHV Group.

New Mexico-based Tramway Venture Partners is out raising its debut fund, with a focus on biotech, medtech and healthtech deals.

Startup leaders aren’t counting on fast policy changes; some see a slowdown in new business and hiring

Luxembourg-based private equity firm Archeide Lux has launched Innovazione Italia, a VC fund with a €50m hard-cap.

Mid-market Chicago buyout house CIVC Partners is back in the fundraising market for what could be its biggest-ever investment vehicle.

Data and analytics-centric investment house 645 Ventures has soared past its Fund III target to reach a $160m final close.

German resilience is helping the DACH region power towards its highest annual private equity deal value total for a decade despite the bruising impact of the coronavirus pandemic on firms across the globe.

Recent Comments