BGF-backed Hobs sells Anexsys

BGF portfolio company Hobs has sold its subsidiary Anexsys to Xact Data Discovery (XDD).

BGF portfolio company Hobs has sold its subsidiary Anexsys to Xact Data Discovery (XDD).

Finland-based venture capital investors Tesi and NordicNinja have participated in a $54m series-C round of funding for Finnish virtual reality hardware and software developer Varjo.

Clearlake Capital-backed IT management and security software business Ivanti has picked up new investment from global private equity player TA Associates.

Spanish private equity house Moira Capital Partners has made its third deal since the start of the coronavirus crisis by buying into 'enhanced reality' software business Voovio.

MiddleGround Capital has acquired majority ownership of Dura Automotive Systems from Bardin Hill Investment Partners. The buy of Dura is MiddleGround’s sixth platform acquisition in its first fund which closed in August 2019. Dura Automotive

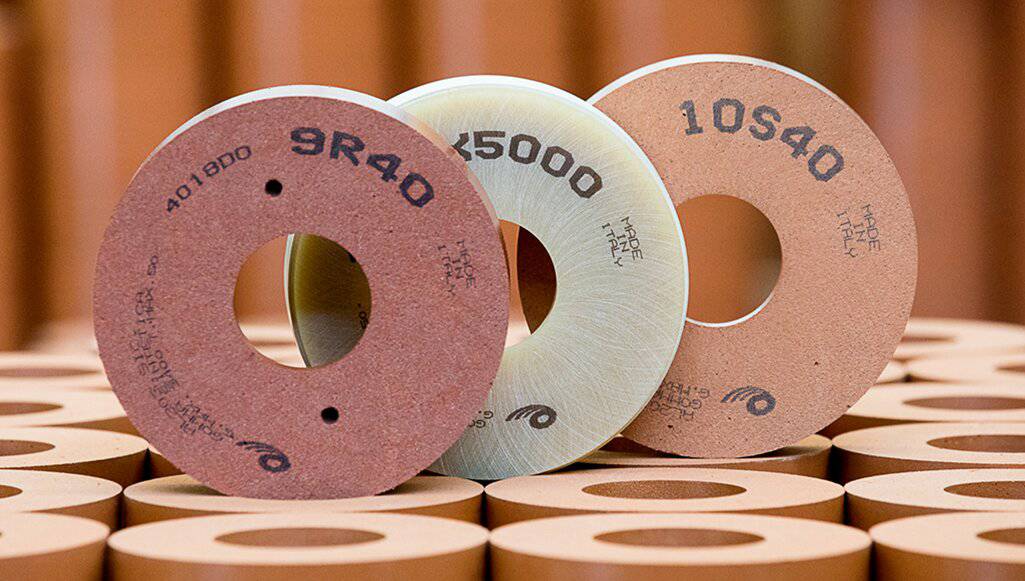

Astorg has agreed to sell its portfolio company Surfaces Group to TA Associates. Surfaces Group is a supplier of abrasive tools and consumables used in the manufacturing process of high-end materials. The group’s products are

Noble Foods Nutrition, a contract manufacturer of nutrition and energy bars and a portfolio company of Novacap, has acquired the co-packing activities of Betty Lou’s, an energy bar manufacturer. Betty Lou’s, under its own brand

Saxony elected to bring a 15 year benchmark to market on Tuesday, launching the deal in an otherwise deserted primary market. The negative yield told against the deal, which was sold without being fully subscribed.

Dublin-headquartered startup Antikytera E-Technologies has received an investment from a venture capital house to further expand its remote assistance software and artificial intelligence technology.

Germany-based venture capital investors EVentures, 468 Capital and HV Holtzbrinck Ventures have backed a €5m seed round for Klima, an app that allows users to make donations to mitigate their carbon footprint.

Mid-market US private equity house Stellex Capital Management has expanded its operations through the opening of a new office in Michigan.

Industry giant Mittal, the Swarovski family and Skype co-founder Niklas Zennström are all among backers of a €50m fund raised by woman-led venture capital firm La Famiglia.

GlobalCapital Asia has spent the last two months talking to banks and their clients to determine the most impressive capital markets transactions and advisers across Asia ex-Japan in 2020, a volatile and unpredictable year. We

GlobalCapital Asia has spent the last two months talking to banks and their clients to determine the most impressive capital markets transactions and advisers across Asia ex-Japan in 2020, a volatile and unpredictable year. We

Chinese property developer Logan Group Co courted investors with a six year bond on Monday, raising $300m from a solid order book of $3.3bn.

Chinese property developer Logan Group Co courted investors with a six year bond on Monday, raising $300m from a solid order book of $3.3bn.

Suzhou SND Group Co, a Chinese local government financing vehicle (LGFV), got lukewarm support for its debut dollar bond on Monday, forcing it to offer a bit of premium to get its deal past the

Laxman Pai, Opalesque Asia: European private equity and venture capital entry volume dropped to a five-year low in the first half of 2020 as managers turned away from deal-making to focus on their existing portfolios

Genstar has acquired Sonny’s Enterprises, a manufacturer of car wash equipment and supplies, from Sentinel Capital Partners. Sonny’s is the largest manufacturer and distributor of conveyorized car wash equipment, parts and supplies in the world

ERI Solutions, a portfolio company of Spire Capital since November 2018, has acquired DBI Group. DBI is a provider of non-destructive testing, mechanical integrity inspections, pipeline integrity inspections, and heat treating services. The company, led

Recent Comments