Armonia-backed Biodue buys Farcoderma

Milan-listed cosmetics producer Biodue, a portfolio company of Italian private equity firm Armonia, has wholly acquired food supplements specialist Farcoderma.

Milan-listed cosmetics producer Biodue, a portfolio company of Italian private equity firm Armonia, has wholly acquired food supplements specialist Farcoderma.

Visma, a PE-backed Norwegian cloud software company, has acquired Rotterdam-based accounting software company Yuki.

YFM Equity Partners portfolio company DSP has acquired Oracle software consultancy Explorer UK.

Private equity-backed investment management software business Clearwater Analytics is reportedly eyeing a sale which could value the business at $2bn.

Apollo Global has seen a disappointing IPO for portfolio business Rackspace value the business at about $4.18bn - less than the company's $4.3bn valuation when Apollo took it private four years ago.

US private equity major Thoma Bravo has agreed a buyout of Foundation Software, a provider of construction accounting software and payroll services for small-to-mid-sized specialty contractors.

The deal values Diligent at north of $4bn

NEW YORK--(BUSINESS WIRE)-- KKR & Co. Inc. (NYSE: KKR) today reported its second quarter 2020 results, which have been posted to the Investor Center section of KKR’s website at https://ir.kkr.com/events-presentations/. This press release features multimedia.

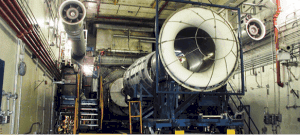

After just over a five-year hold, Gen Cap America has sold Aero Systems Engineering to Calspan Technology. Aero Systems Engineering (ASE) designs, builds and upgrades jet engine testing and wind tunnel facilities, and provides lab

Publicly traded Triumph Group has agreed to sell its aerospace composites operations to Arlington Capital Partners. The Triumph composites operations (TCO) – with locations in Milledgeville, Georgia (650,000 sq. ft.) and Rayong, Thailand (135,000 sq.

MSD Partners has held a final closing of MSD Special Investments Fund LP with $825 million in capital. The new fund had a target of $500 million. MSD Partners was formed in 2009 by the

Opalesque Industry Update - Prime Capital AG, the independent asset manager and financial services provider that manages amp;euro;17.2bn across multiple funds, is launching the Liquid Alternative Credit Fund, a new fund of funds, beginning of

The group said it is in talks with Centerbridge Partners Europe and TowerBrook Capital Partners; Platinum Equity Advisors; and Warburg Pincus International

Hg has secured a majority stake in portfolio company Evaluate following an additional investment in the pharmaceuticals analytics business.

So far, 47 firms have signed up to Initiative Climat International (iCI), a global network that will share knowledge, tools, experience, and best practice to help build and manage both climate-aligned and climate-resilient portfolios

Recent Comments