Afinum exits Garz & Fricke in EUR 180m trade sale

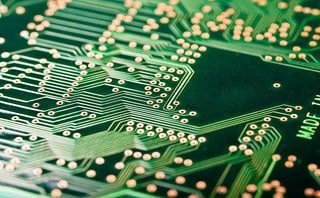

Afinum Beteiligungsgesellschaft has sold its stake in human-machine interface (HMI) software and hardware developer Garz & Fricke (G&F) in a EUR 180m trade sale to listed Italy-based Seco.

Afinum Beteiligungsgesellschaft has sold its stake in human-machine interface (HMI) software and hardware developer Garz & Fricke (G&F) in a EUR 180m trade sale to listed Italy-based Seco.

Private equity-backed enterprise software business Informatica is eyeing a return to the stock market which could see it valued at up to $9bn. The post PE-backed Informatica eyes $9bn valuation in stock market return first

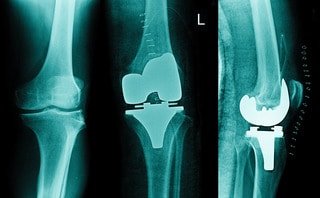

Private equity firm EQT has kicked off the sale of portfolio company LimaCorporate, according to five sources.

Argos Wityu could revisit the sale of portfolio company Fabbri Vignola in 12-18 months after shelving a process to exit the Italian fresh food packaging company late last month, according to several sources.

Main Capital Partners has sold its stake in Germany-based banking and insurance software developer B+M in a secondary buyout to software investor LEA Partners, scoring returns of 3x money on the exit.

Private equity major HIG Capital has paid almost $20m to settle a lawsuit claiming its mental health company portfolio business South Bay fraudulently billed Medicaid for services provided by unlicensed, unqualified, and improperly supervised staff.

US pension giant LACERA is the latest big instutional investor to commit to Clearlake Capital's hefty new fundraise, which is reportedly targeting $10bn. The post Clearlake gets another big LP commitment towards $10bn-targeting new fund

PAI Partners is leaning towards a US initial public offering of Refresco, sources familiar with the matter said, setting up Europe's largest independent beverage bottler for a return to the public markets.

EQT has announced that it has set science-based targets (SBT) for greenhouse gas emissions that will apply to its own operations and its portfolio companies.

Francisco Partners has followed yesterday's $2.2bn credit fund close with a growth investment in Paradigm, a provider of practice management software and integrated payments to the legal industry. The post Francisco Partners follows $2.2bn credit

Switzerland-headquartered Ufenau Capital Partners expects to launch the fundraise for Ufenau VII German Asset Light in Q1 2022, managing partner Ralf Flore has told Unquote.

Blackstone has kicked off the sale of German measurement technology group Schenck Process, sources familiar with the matter said, potentially generating as much as EUR 1.5bn in proceeds.

Laxman Pai, Opalesque Asia: U.S. institutional investors representing more than $12 trillion in AUM in a recent survey said they anticipate downward pressure on their ability to outperform against their return targets an...Article Link

Recent Comments