Fund VI Largest Ever for FTV

FTV has closed its sixth and largest fund to date, FTV VI LP, at its hard cap of $1.2 billion. The firm’s earlier fund closed in September 2016 at its hard cap of $850 million.

FTV has closed its sixth and largest fund to date, FTV VI LP, at its hard cap of $1.2 billion. The firm’s earlier fund closed in September 2016 at its hard cap of $850 million.

According to CEO Pierre-François Thaler private equity firms need to be extra careful on how they manage their portfolios now to prevent future reputational risks

Eurazeo portfolio company Planet has acquired payments company 3C Payment.

Kitchen design business Poggenpohl, an Adcuram portfolio company that entered self-administration proceedings in April 2020, has been sold to UK-based market peer Lux Group as part of the company's ongoing restructuring.

PWP Growth Equity has completed its spin-out from Perella Weinberg. The new firm – now operating as GreyLion Capital – will continue to manage its two existing private equity funds with total capital commitments of

The group launched company voluntary arrangements in the UK and North America as the high street reels from the pandemic

Osceola Capital has held a hard cap and above target close of its inaugural fund with an oversubscribed $125 million of capital. Limited partners in the new fund include public pension plans, financial institutions, a

Idinvest has sold a group of 12 growth-stage companies to a newly established fund, Idinvest Growth Secondary SLP, backed by fresh secondary capital and offering liquidity to existing investors.

The buyout group formed a joint venture with Safestore in August 2019 to enter the self-storage market in the Netherlands

Companies in the portfolio include audio streaming service Deezer, industrial group Forsee Power and video cloud platform Sightcall

Germany-based payments service Heidelpay, a portfolio company of KKR, has acquired a stake in iPad-based contactless payment software company Tillhub.

Ardian portfolio company Gantner, an Austria-based deverloper of an electronic ticketing and billing system, has acquired catering cashless payments company Contidata.

Turkey Hill, a portfolio company of Peak Rock Capital, has acquired an ice cream production facility from Yarnell Ice Cream, a subsidiary of Schulze & Burch Biscuit Company. Turkey Hill produces iced teas, fruit drinks,

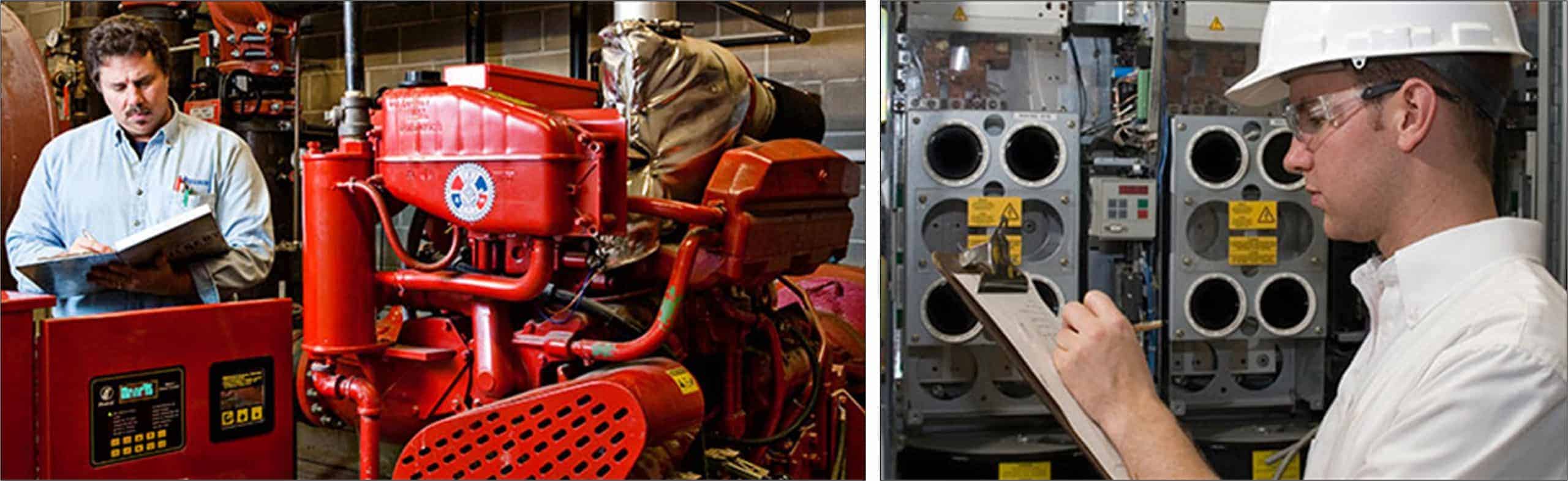

Therma Holdings, a portfolio company of Gemspring Capital, has acquired Gilbert Mechanical Contractors. Gilbert is Therma’s fourth acquisition since being acquired by Gemspring in June 2017. Gilbert is a provider of mechanical, electrical, plumbing, controls,

Tanknology, a portfolio company of Hamilton Robinson Capital Partners since September 2019, has acquired Compliance Testing & Technology (CCT). CCT is a provider of underground storage tank (UST) and aboveground storage tank (AST) compliance services,

Fulcrum Equity Partners has promoted Philip Lewis to partner. Mr. Lewis joined Fulcrum as an analyst in 2007. “We’re proud to announce Philip’s well-earned promotion to partner. Philip has grown tremendously both professionally and personally

Ophthalmology company Rodenstock, a portfolio company of Compass Partners, has announced the completion of an equity capital increase of up to €75m from its existing investors.

Enterprise Investors (EI) portfolio company Anwim is in the process of acquiring EMila, a Polish network of self-service petrol stations.

Information and communications technology (ICT) business Impresoft, a portfolio company of Italian GP Xenon Private Equity, has acquired digital transformation specialist Progel.

LYNX Franchising, a portfolio company of Incline Equity Partners, has acquired FRSTeam, a provider of disaster recovery services. FRSTeam (Fabric Restoration Service Team) specializes in the restoration of clothing and textiles damaged by smoke, fire,

Recent Comments