Troy Medicare Announces $10M Series B led by AXA Venture Partners

We asked Balderton Capital, Passion Capital and more about their top picks

Some 64% of limited partners want to increase investment into female-led venture capital firms

The growth of this industry will represent an opportunity for private equity funds looking to deploy large amounts of capital in ESG focused sectors.

Portuguese venture capital firm Faber Ventures has held a first close on €20.5m for its new fund Faber Tech II.

The $45.2bn-managing Illinois Municipal Retirement Fund has agreed $85m of new venture capital investments across a string of funds.

In the week ending November 13th 2020, Preqin said that it expects hedge funds to hold onto their position as the second-largest alternative asset class in 2025, despite relatively weak growth in assets under management...Article

In the week ending November 13th 2020, Preqin said that it expects hedge funds to hold onto their position as the second-largest alternative asset class in 2025, despite relatively weak growth in assets under management

In the week ending November 13th 2020, Preqin said that it expects hedge funds to hold onto their position as the second-largest alternative asset class in 2025, despite relatively weak growth in assets under management

European M&A activity has scored a sharp recovery from near-decade lows caused by the coronavirus crisis - but annual figures are still trending towards their worst result in years, new research shows.

Kurma Partners and Sunstone Life Science Ventures have led a CHF 20m series-A funding round for Switzerland-based Synendos Therapeutics, a company that develops therapies for central nervous system (CNS) disorders.

Aglaé Ventures and BPI france Digital Venture have led a $30m series-B funding round for video conferencing software developer Livestorm.

Opalesque Industry Update - The majority of the largest asset managers worldwide faced a second consecutive year of declining interest in their corporate brands, according to Peregrine Communications' second annual Global 100 report into the

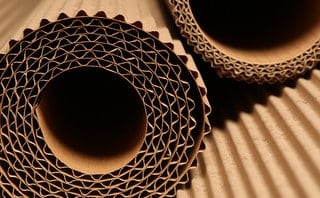

Second-round bids are due early Decemeber for Finnish cardboard packaging manufacturer Kotkamills, according a report by Unquote sister publication Mergermarket.

Recent Comments