Marquee Brands Acquires Sur La Table

Marquee Brands and CSC Generation have agreed to acquire the Sur La Table brand and all of its related intellectual property for $88.9 million. Seattle-based Sur La Table (French for “on the table”) is a

Marquee Brands and CSC Generation have agreed to acquire the Sur La Table brand and all of its related intellectual property for $88.9 million. Seattle-based Sur La Table (French for “on the table”) is a

According to a new report from Lincoln International, as the initial shockwaves of the global pandemic subside, both middle market private equity firms and lenders have proven supportive as portfolio companies navigated the financial challenges

Although women-led businesses are more likely to yield market-beating returns, they are woefully neglected by venture capital firms, which are dominated by men

The firm told employees to avoid using buses or trains when offices reopen to stop staff spreading coronavirus

Forensic Engineering Services, a portfolio company of Trinity Hunt Partners, has acquired Scientific Analysis. Scientific Analysis (SAI) is a provider of forensic engineering services used in accident reconstruction. The company provides a range of investigation,

Patient Square Capital has been launched in Menlo Park, California by Jim Momtazee and Maria Walker. Patient Square will invest across the health care industry with a specific interest in technology-enabled services, biopharmaceuticals, pharmaceuticals, medical

Lightspeed India Partners has reportedly bagged $275m from LPs in a new venture fund aimed at supporting early-stage startups in the world's second-largest internet market.

Opalesque Industry Update - The hedge fund industry turned in a fourth consecutive positive month in July as stock markets ' continued strong performance contributed to a 2.76% return, according to the Barclay Hedge Fund

Spanish venture capital house Bullnet Capital has sold version control software (VCS) specialist Codice SW to Unity Technologies, a private-equity-backed US software company.

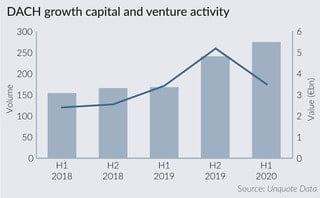

Growth and venture capital deal volume exceeded that of all previous half-yearly figures in the DACH region in H1 2020, making for a busy first half of the year that saw 275 such deals, according

Venture capital performance remained 'unscathed' in the first quarter of 2020 despite the onset of the coronavirus pandemic, as the industry consolidated what had been an exceptional 2019, new research shows.

Initialized Capital, the investment firm launched by Reddit co-founder Alexis Ohanian and ex-Y Combinator partner Garry Tan, has hauled in $230m for its fifth seed fund.

The amount collected by funds globally in the first half of 2020 was 19% greater than in the first half of 2019

Opalesque Industry Update - The hedge fund industry turned in a fourth consecutive positive month in July as stock markets' continued strong performance contributed to a 2.76% return, according to the Barclay Hedge Fund Index,

Laxman Pai, Opalesque Asia: While Europe showed resilience in Q2 2020, there is growing concern that the venture capital (VC) market in Europe could see large impacts in Q3'20 given the widespread effect of COVID-19

Former affiliate of private equity firm TPG would rival the €21.3bn buyout fund CVC Capital Partners completed this summer

Recent Comments