Syntiant Completes $35M Series C Raise with Support of Sunstone Venture Capital

All eyes were on Italy in the primary euro public sector bond market on Tuesday as it pipped Spain for the biggest ever order book for a eurozone sovereign syndicated bond in the 20 year

All eyes were on Italy in the primary euro public sector bond market on Tuesday as it pipped Spain for the biggest ever order book for a eurozone sovereign syndicated bond in the 20 year

The Republic of Poland, the first European country to issue a Panda bond in August 2016, has finished the documentation process for its second onshore renminbi offering, GlobalCapital China understands.

TruFood Manufacturing, a portfolio company of AUA Private Equity since June 2019, has acquired Simply Natural Foods. Simply Natural is a co-manufacturer of confection products including sugarfree, organic, and kosher functional bars (products that include

PolyVision, a portfolio company of Industrial Opportunity Partners (IOP), has acquired Marsh Industries, a manufacturer of visual display boards. IOP acquired PolyVision in February 2020 from publicly traded Steelcase. Marsh Industries is a maker of

Blackstone has agreed to acquire Ancestry from Silver Lake, GIC, Spectrum, and Permira at an enterprise value of $4.7 billion. The buy of Ancestry is the first control acquisition for Blackstone Capital Partners VIII LP

Dieter von Holtzbrinck Ventures (DvH Ventures) has announced the launch of its first Digital Health fund, which has held a first close on €60m.

Turnaround-focused private equity firms White Park Capital and Navigator Capital have carved out anti-theft systems manufacturer Gateway from listed security firm Gunnebo via Aralia Holding.

A trio of private equity majors look set to complete their agreed €2.96bn buyout of listed Spanish telecoms operator MasMovil after no rival offers for the company emerged.

Victor Christou joins as head of growth, responsible for seeking new investment opportunities in high-growth technology ventures

Genesis Capital has acquired a majority stake in Czech Republic-based digital advertising business B2B2.

Opalesque Industry Update - Private Equity investment commitments from public pensions tracked by eVestment more than tripled from May to June this year, ending a three-month drop off in commitments that began in March as

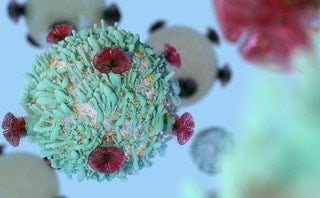

Versant Ventures has invested $30m in Switzerland-based Matterhorn Biosciences to launch the company and assist with the development of its T-cell therapy technology for cancer treatment.

PME Investimentos has invested in a €4m series-A round for Portuguese company PicAdvanced, a manufacturer of optical transceivers.

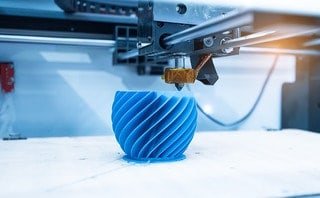

Nordic Alpha Partners has backed a $14m series-B round for Germany-based 3D printing company DyeMansion, alongside the company's existing investors UVC Partners, BtoV Partners, KGAL and AM Ventures.

Versant Ventures and RA Capital Management have led a €66m series-A funding round for T-knife, an adoptive T-cell therapy developer based in Germany.

The Los Angeles-based asset manager is on track to collect at least $30bn this year despite disruptions from the coronavirus pandemic

Recent Comments