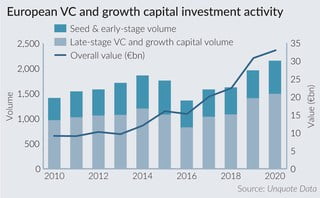

AMB :- Early-stage funding rounds accounted for 70.8% of global VC funding deal volume in Q4 2020

Laxman Pai, Opalesque Asia: Early-stage funding rounds (comprising Seed and Series A funding rounds) continued to dominate the global VC funding landscape in terms of deal volume during the quarter, as venture capital (V...Article Link

Recent Comments