Ex-NEA veteran Kolluri raises $216m for second Neotribe fund, says “no idea is too crazy”

Veteran former NEA general partner Kittu Kolluri is back with his second Neotribe Ventures fund, which has hit $216m for its final close.

Veteran former NEA general partner Kittu Kolluri is back with his second Neotribe Ventures fund, which has hit $216m for its final close.

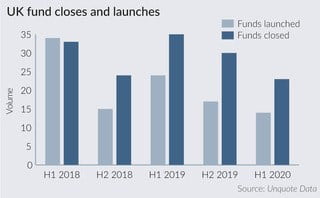

A number of Ireland- and UK-based GPs that closed their most recent funds more than three years ago have delayed fundraises to either later in 2020 or 2021, or have altogether decided to explore new

Mountain Capital, the energy-focused private equity house launched by former Apollo senior partner Sam Oh, is reportedly nearing its $650m goal for its sophomore fundraise.

Blackstone's secondaries arm Strategic Partners has closed what is believed to be the world's biggest infrastructure secondaries fund on $3.75bn.

Asset management major Schroders has hit a €312m first close for its new fund targeting sub-investment grade infrastructure debt.

Balance Point Capital Partners is already back in the fundraising market for its fifth flagship fund, despite only closing its $1.1bn fourth vehicle in March.

European investor Capza has hit a €450m first close for its latest fundraise, putting it within touching distance of its €500m goal.

Funds have lost cornerstone investors while at the same time being engaged in a deal

Fundraising and dealmaking took a hit in the first half of 2020, but industry experts are now beginning to see some shoots of recovery return to the market

Laxman Pai, Opalesque Asia: UK private equity fundraising surged to more than £47.5bn ($60bn) last year amid a more than doubling of capital flowing into venture capital fundraises, said a study. UK private equity and

A cloud of uncertainty was placed on the private equity fundraising market back when global coronavirus lockdowns began. While a lot of theories suggested LPs would be less interested in backing funds, or be hamstrung

UK private equity fundraising surged to more than £47.5bn last year amid a more than doubling of capital flowing into venture capital fundraises, new data from industry body BVCA shows.

Baird managing directors Vinay Ghai (financial sponsors) and Paul Bail (debt advisory) speak to Unquote about their outlook on market sentiment, dealflow and fundraising

Blackstone, one of the biggest real estate private equity operators in the world, has hauled in $1.9bn for the final close of its latest secondaries fund dedicated to the asset class.

Carlyle is reportedly eyeing up to $2bn for a new fund dedicated to mid-market North American private equity deals amid a tweak in its growth investing strategy.

Guardian Capital Partners has picked up $282m for the hard cap final close of its third flagship fundraise, six years after closing its predecessor vehicle.

Private equity real estate specialist Castleforge Partners has hauled in more than £270m for the final close of its third flagship fundraise.

Brookfield Asset Management has hit an initial €725m close for its first European core-plus real estate fund as it looks to take advantage of volatility in the current market.

Private equity firms spend millions of dollars each year on legal services and increasingly are taking a closer look at this expense category according to a new study by Apperio entitled “Rocketing Scrutiny, Eroding Trust

Limited partners are increasingly turning to debt and mezzanine infrastructure funds as they hunt for relatively safe havens for their investments amid the ongoing Covid-19 pandemic.

Recent Comments