Central Europe-focused Genesis Capital back with €150m-targeting fundraise

Central Europe-focused private equity house Genesis Capital has launched a €150m fundraise for its sixth flagship buyout vehicle.

Central Europe-focused private equity house Genesis Capital has launched a €150m fundraise for its sixth flagship buyout vehicle.

London-based investment house Connect Ventures has sealed a £65m fundraise targeting seed-stage tech deals across Europe.

Italian private equity firm Clessidra is preparing the launch of its fourth buyout fund, which will have a target of around €600m and will start fundraising in the coming months, Unquote understands.

KKR has hauled in more than $10bn for its fourth pan-Asian private equity fund, putting it within a whisker of becoming the biggest-ever PE vehicle raised targeting the region.

UK-based private equity house Tenzing has raced to a £400m final close for its sophomore fund in what is believed to be the first buyout fund raised entirely virtually.

LA-based early-stage investment house Upfront Ventures is back in the fundraising market with its seventh flagship fund.

Specialist investment firm Corten Capital has held the €392m final close for its maiden fund, which will back technology-driven B2B services.

The Madrid-based firm said fundraising took just a few weeks despite the Covid-19 distress, attracting international investors

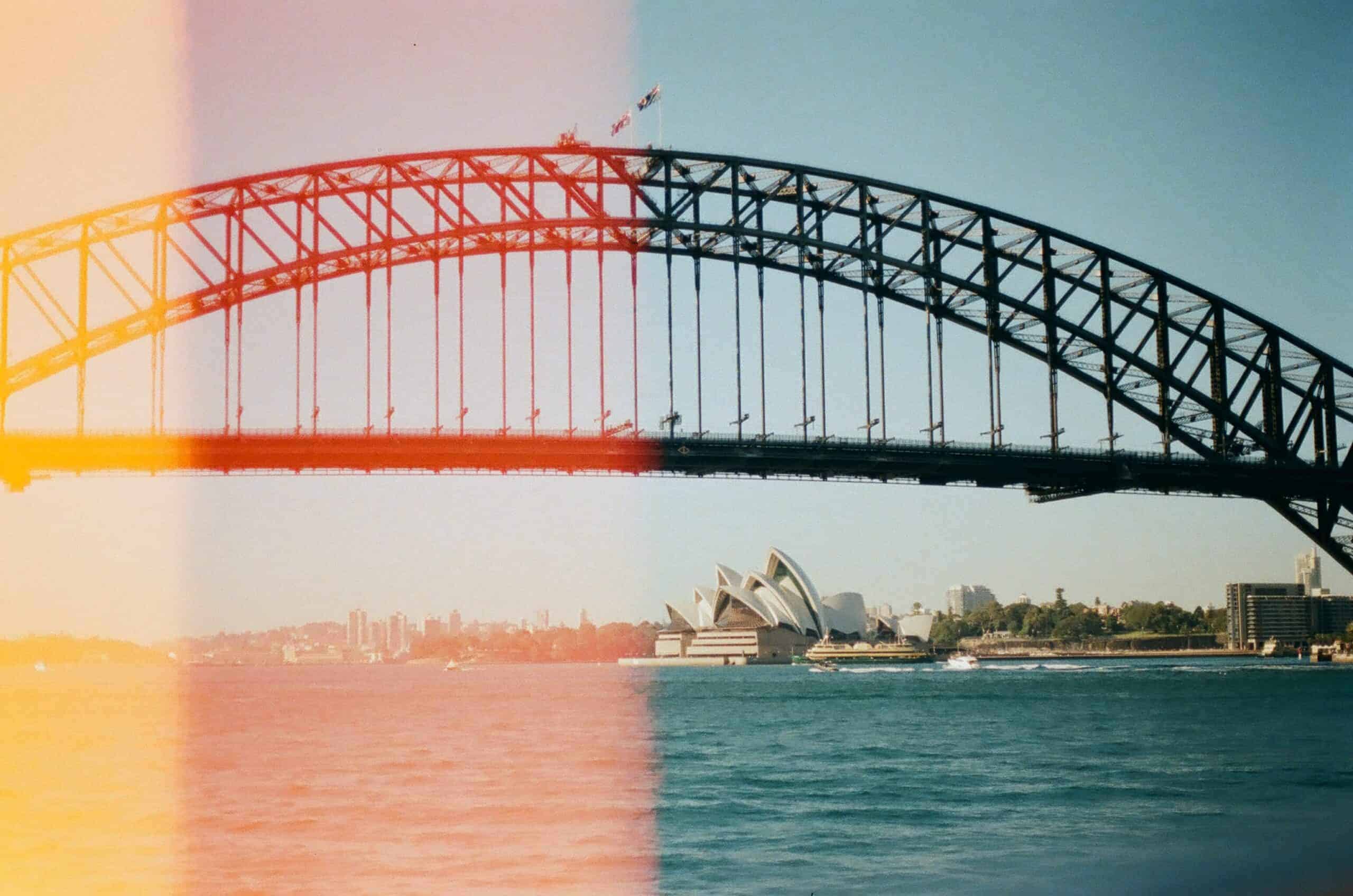

Riverside has raised more than $260m towards its latest Asia-Pacific fund, which the firm has rebranded to underline its heavy focus on the Australasian market.

Laxman Pai, Opalesque Asia: The global alternative investment manager Ares Management closed its Ares Special Opportunities Fund (ASOF) at $3.5 billion. The private debt fund well exceeded its $2 billion fundraising targ...Article Link

Ares Management has surged past its target to reach a $3.5bn final close for a new special opportunities fund.

Private equity professionals are bracing themselves for a swathe of term extensions for existing funds amid the fallout from the ongoing coronavirus crisis, new research shows.

Life sciences-focused venture capital firm Epidarex Capital has hit a £102m final close for its third fund.

MSD Partners, a subsidiary of Michael Dell's family private investment firm, has pulled in more than $1.1bn for the target-busting final close of its Real Estate Credit Opportunities Fund.

The coronavirus crisis is causing difficulties for buyout groups, but those that can attract fresh capital are set for bumper returns

FTV has closed its sixth and largest fund to date, FTV VI LP, at its hard cap of $1.2 billion. The firm’s earlier fund closed in September 2016 at its hard cap of $850 million.

Staveley decided to sue Barclays because she thought that the bank 'would want to settle', Barclays QC suggested in the High Court

Ares Management has yet another vehicle in the fundraising market, with it looking to raise a climate infrastructure fund.

Early-stage investor Good Growth Capital has entered the fundraising market, with the aim of raising $100m for its new vehicle.

BlackRock has pulled in up to $166m for its latest Securitized Investors fund, which has a target of $1bn.

Recent Comments