The Bolt-Ons Digest – 14 December 2022

The Bolt-ons Digest is a compilation done by Unquote with the main add-on deals announced by PE-backed companies in Europe over the last few days.

The Bolt-ons Digest is a compilation done by Unquote with the main add-on deals announced by PE-backed companies in Europe over the last few days.

Tech sponsor Hg has agreed to sell Transporeon to US-listed industrial technology group Trimble in a deal that values the German transportation management software provider at EUR 1.88bn.

Kester Capital has agreed to sell Vixio Regulatory Intelligence, a UK-based provider of global regulatory intelligence to the payments and gambling markets, to European private equity investor Perwyn.

Austrian VC firm Speedinvest has raised EUR 500m for its fourth flagship fund and held a EUR 80m final close for its Climate & Industry Opportunity vehicle.

William Blair has opened an office in Madrid and added investment banking capabilities to its Zurich office.

France-headquartered private equity asset manager Mircap Partners is aiming to hold a first close for its debut co-investment fund by the end of 2022, founding partner Michele Mezzarobba told Unquote.

Two thirds of large LPs and public pension funds are citing the denominator effect as a factor that is slowing down the pace of their commitments to private equity, Coller Capital’s latest Global Private Equity

Intermediate Capital Group is in the early stages of exploring a sale of With Intelligence, the data and intelligence service used by the asset management industry, sources familiar with the matter said.

Pan-European growth equity fund Move Capital plans to secure a final close for its debut European growth technology fund by H1 2023, co-founders Sophie Sursock and Hervé Malaussena told Unquote.

EQT has transferred its minority stake in Swiss drug delivery manufacturer SHL Medical to EQT Future, the GP's new impact-driven, longer-hold investment strategy.

Bicycle manufacturer Pinarello will hit the Italian auction pipeline in a process guided by Houlihan Lokey, a source close to and a source familiar with the situation said.

Christophe de Dardel is to take up the role of the CEO at Switzerland-headquartered asset manager Unigestion from 1 January 2023, succeeding Fiona Frick after her 12-year tenure in the role.

US software investor Thoma Bravo has completed fundraising for its buyout funds totaling more than USD 32.4bn in capital commitments.

One of Africa's biggest private equity firms is being bought by The Rohatyn Group to create a combined firm with almost $8bn of assets under management. The post Rohaytn buys South African private equity major

African private equity major Helios Investment Partners has invested in two data centre providers in Morocco and Kenya. The post Helios looks to build African data centre pioneers with double investment first appeared on AltAssets

The mid-market team at South African private equity major Ethos is spinning out to form a new firm called Infinite Partners. The post South African PE major Ethos spins out mid-market arm to form Infinite

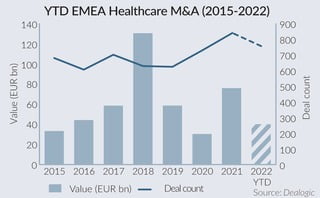

Times might be hard for dealmakers in Europe, the Middle East and Africa (EMEA), but healthcare remains one of the most resilient sectors. And private equity (PE) firms are betting on platform-building as a winning

Gulf Capital has scored a better than 15% IRR selling North African olive oil exporter CHO Group. During its almost four-year ownership Gulf saw CHO grow its revenues by about 33% and double the number

Africa has scored one of its strongest six months of private equity and venture capital investment ever, with $4.7bn of new capital flowing into companies in the continent. The post Africa records one of its

African investment major Development Partners International has sold its stake in Egyptian electronics retailer B.TECH after huge sales and profit increases at the company. The post Huge profit rise at Egyptian retailer B.TECH sees DPI’s

Recent Comments