Palamon exits Feelunique in GBP 132m sale to Sephora

Palamon Capital Partners has sold its stake in online beauty products retailer Feelunique to beauty retailer Sephora in a deal that values Feelunique at GBP 132m.

Palamon Capital Partners has sold its stake in online beauty products retailer Feelunique to beauty retailer Sephora in a deal that values Feelunique at GBP 132m.

Index Ventures has raised a hefty $2.9bn across its latest heavyweight venture capital funds, as well as another $200m for its first seed-focused vehicle. The post Index Ventures hauls in hefty $2.9bn across two new

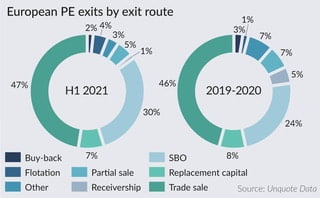

European private equity players' strong appetite to deploy has noticeably boosted the prevalence of secondary buyouts as an exit route this year, according to Unquote Data.

Global buyout giant Carlyle us reportedlying looking to raise the biggest private equity fund in history by eyeing up to $27bn for its latest flagship vehicle. The post Carlyle eyes world’s biggest buyout fund at

Credit investment major King Street Capital Management has hit a $1.2bn final close for its debut Global Drawdown Fund, smashing its $750m target. The post King Street smashes target for debut Global Drawdown Fund, closes

Software-focused private equity investor Five Elms Capital has raised its biggest-ever fund by closing its fifth flagship vehicle on $780m. The post Five Elms Capital sees fund size rocket again with $780m Fund V final

Clearlake Capital Group has agreed to acquire BakeMark from Pamplona Capital Management. BakeMark is a manufacturer and distributor of bakery ingredients and supplies including mixes, fillings, icings, glazes, commodities (eggs, flour, and dairy), frozen products

Align Capital Partners has sold its environmental testing and compliance platform, Alliance Technical Group, to Morgan Stanley Capital Partners. Alliance provides source testing, emissions monitoring and analytical services to industrial facilities for permitting and compliance

Integrated Facility Solutions (IFS), a portfolio company of Warren Equity, has acquired Multigas Detection. The buy of Multigas was made through Concept Controls, a subsidiary of IFS. Multigas distributes, services, calibrates, and maintains fixed gas

India's Motilal Oswal Private Equity is eyeing almost $540m for its fourth fund targeting the country. The post India’s Motilal Oswal PE eyes $540m for fourth fund first appeared on AltAssets Private Equity News.

Global buyout giant KKR has announced two deals in one day by buying into digital education platform Teaching Strategies and investing into a new diagnostic platform to support healthcare companies. The post KKR taps $8.5bn

Apax Partners has continued its strong fundraising year through a target-busting €1.6bn final close of its tenth mid-market investment vehicle. The post Apax Partners continues busy 2021 fundraising activity with €1.6bn close of tenth mid-market

Ince Capital, the private equity firm launched by a pair of former Qiming Venture Partners execs, has reportedly reached a $450m first close for its sophomore fundraise. The post Ex-Qiming pair said to strike $450m

XL Marketing, a digital and direct marketing company, today announced an investment by private equity firm GCP Capital Partners as well as a debt facility agented by Madison Capital Funding. The $70 million capital raise

OMERS Private Equity has signed an agreement to acquire Lifeways, a provider of supported living services for adults with learning disabilities in the UK, from August Equity. Lifeways management will re-invest substantially alongside OMERS. According

Centre Partners announced today that it has acquired Taylor Precision Products,, a marketer of consumer and foodservice measurement products, from Homedics. “We are pleased to invest in Taylor and to establish the business as an

LaSalle Capital Group held a final closing on its second fund with $205 million in commitments, substantially exceeding its initial target of $150 million. Fund II commitments include significant institutional investments from pension funds, foundations,

Milestone Partners has completed the acquisition of Southern Management Corporation, a consumer finance company. “Southern is a tremendous and well respected platform within the highly fragmented consumer installment loan industry providing essential access to loans

Recent Comments