Lunar raises €40m in series-C funding

Digital bank Lunar has raised €40m in series-C funding from existing investors.

Digital bank Lunar has raised €40m in series-C funding from existing investors.

Cornerstone Capital has sold Germany-based metal foils producer EppsteinFoils to Switzerland-based market peer Artum.

Atwater Capital has acquired a minority stake in EQT-backed Freepik, a Spanish provider of digital visual content.

'Businesses and job seekers are struggling with the impact of the pandemic and worried about what a second wave will mean, but we also can’t forget about Brexit,' said Morgan McKinley

As the private equity veteran prepares to bow out, he talks about some of the highs and lows of his 40-plus years in the industry

Polish buyout firm Abris Capital Partners has signed an agreement to sell its stake in Polish locomotive lessor Cargounit, also known as Industrial Division, to Three Seas Investment Fund (3SIIF).

Gimv has sold a stake in the home care division of Eurocept, a home care and pharmaceuticals company.

Security operations developer Arctic Wolf has joined the unicorn club after a $200m Series E puts its valuation at $1.3bn.

The firm reduced its fundraising target after a top executive was caught in the 2019 college-cheating scandal

High-Tech Gründerfonds (HTGF) and Evonik Venture Capital have sold their stakes in Finnish company Synoste to US-based medical device manufacturer Globus Medical.

Private equity-backed cybersecurity major McAfee has hit an $8.6bn valuation through its return to the public market through an IPO.

Venture capital investor SVB Capital is looking to raise up to $250m for its fifth early-stage investment fund.

A pair of former Pilot Growth Equity veterans are hoping to raise up to $200 for their debut Invictus Growth Partners fund.

Amplify Partners has upped its fundraising game by raising $375m across a pair of new investment vehicles.

Unquote compiles some of the most notable fundraises in the DACH region in the buyout, venture and secondaries spaces, with the latest available intel for each vehicle.

High-Tech Gründerfonds (HTGF) and Bayern Kapital have sold their stakes in Germany-based nanobodies development company ChromoTek to US-based antibody developer Proteintech.

Chinese private equity and venture capital major Legend Capital has hit a $500m hard cap close for its eighth flagship fundraise.

Warburg Pincus' former global healthcare head is out eyeing up to $300m for the debut fundraise from his firm Ascend Partners.

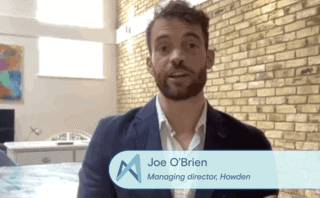

Unquote interviews Joe O'Brien from Howden M&A, the winner of the M&A Insurance Broker Of The Year category at the 2020 British Private Equity Awards.

Recent Comments