17Capital gears up for Fund 6

NAV-based preferred equity and credit provider 17Capital has made several legal filings in Luxembourg relating to its next flagship fund, 17Capital Fund 6.

NAV-based preferred equity and credit provider 17Capital has made several legal filings in Luxembourg relating to its next flagship fund, 17Capital Fund 6.

CVC was considering exit options for Mehiläinen earlier in 2022 but has decided to hold onto the Finnish healthcare group for another few years, according to three sources familiar with the situation.

Capvis has agreed to invest in privately-owned Hamburg-based AdEx Partners, an IT strategy and digital services consultancy.

European mid-market sponsor Equistone is banking on the multi-cycle experience of its team to carry the firm and its portfolio through the next storm as it looks towards future fundraising and portfolio development, UK-based partner

Ares Management is reportedly seeking to raise more than $45bn for its latest batch of funds. The post Ares Management is seeking over $45bn for next batch of funds – report first appeared on AltAssets

UK investment house BGF has completed the exit of bakery St Pierre Groupe to Grupo Bimbo, earning an IRR of 85%. The post BGF earns 9.6x return on exit of bakery St Pierre Groupe first

Mid-market sponsor IK Partners has invested in France-based Plus que Pro, a digital platform that allows businesses and customers to find and advertise construction and business services, alongside co-founders Gregory Regouby and Sacha Goepp.

French asset manager Mirabaud is looking to raise a second private equity fund targeting “living heritage” affordable luxury consumer goods with a EUR 300m target, said head of private equity Renaud Dutreil.

Private equity giant KKR has reportedly raised nearly $1.9bn for its second global impact fund. The post KKR raises $1.9bn for its sophomore global impact fund, so far first appeared on AltAssets Private Equity News.

European private equity firm IK Partners has invested into France-based digital platform and services company Plus que PRO, alongside the co-founders Gregory Regouby and Sacha Goepp. The post IK Partners backs French digital services company

Private equity giant KKR has agreed to acquire 100% of Ness Digital Engineering, a full-lifecycle digital services transformation company, from The Rohatyn Group. The post KKR taps Asian Fund IV for digitalisation company Ness Digital

October 27, 2022 – KKR, a leading global investment firm, today announced the signing of definitive agreements under which KKR will acquire 100% of Ness Digital Engineering (“Ness” or "the “Company”), a global full-lifecycle digital

Unquote speaks to Agnieszka Pakulska, a partner at Poland-based sponsor Avallon, about the GP’s current outlook and her career, as part of the new Women in Private Equity series.

Ardian has sold its stake in French CDMO Unither to a consortium led by GIC and IK Partners, joined by existing investors Keensight Capital and Parquest.

Unigestion, an independent, specialist asset manager, has held the first close of its third direct private equity fund on €200m. The post Unigestion reaches first close for third direct private equity fund first appeared on

Ridgemont Equity Partners, a buyout and growth investment firm, has closed its fourth fund on its $2.35bn hard cap. The post Ridgemont Equity Partners hits $2.35bn hard cap for new fund first appeared on AltAssets

Switzerland-headquartered asset manager Unigestion has held a first close for Unigestion Direct III (UD III) on close to EUR 200m against the fund’s EUR 1bn target.

Nordic Capital has held a final close for its 11th fund on its EUR 9bn hard cap after a nine-month roadshow, as GPs struggle against a challenging fundraising environment.

Global private equity investor Warburg Pincus has committed $350m to set up Southeast Asian digital insurance platform Oona. The post Warburg Pincus invests $350m to launch InsurTech Oona first appeared on AltAssets Private Equity News.

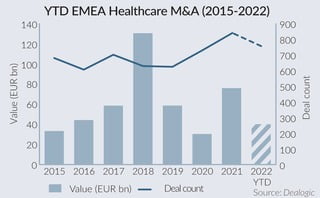

Times might be hard for dealmakers in Europe, the Middle East and Africa (EMEA), but healthcare remains one of the most resilient sectors. And private equity (PE) firms are betting on platform-building as a winning

Recent Comments