Sponsors brave the storm amid drop in financial services M&A

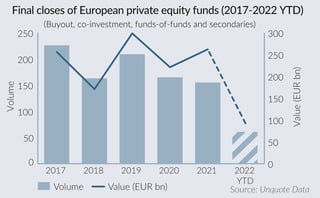

Private equity has remained a driving force for deals in the financial services sector so far this year even as concerns over rising financing costs and a brewing recession cloud the outlook for M&A in

Recent Comments