Great Point Partners Exits Portfolio Company Bionova Scientific

Great Point Partners Exits Portfolio Company Bionova Scientific(PRWeb June 01, 2022)Read the full story at https://www.prweb.com/releases/2022/6/prweb18712442.htm

Great Point Partners Exits Portfolio Company Bionova Scientific(PRWeb June 01, 2022)Read the full story at https://www.prweb.com/releases/2022/6/prweb18712442.htm

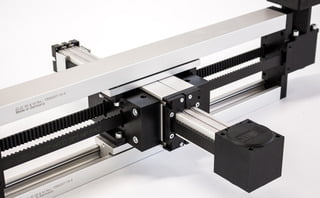

IK Partners is to exit Germany-headquartered modular electric linear motion systems producer Bahr Modultechnik in a EUR 98m trade sale to IMI, a UK-based engineering company.

Pan European buyout house IK Partners has agreed to exit Small Cap II portfolio Bahr Modultechnik to IMI, valuing it at a €98m enterprise value. The post IK Partners exits Small Cap II portfolio Bahr Modultechnik

Private equity firm Livingbridge has hired PwC to explore a sale of its British home care business Helping Hands, according to two sources familiar with the situation.

TDR Capital and Mohsin and Zuber Issa – the founders and co-CEOs of petrol station forecourt retailer business EG Group – are considering to walk away from its proposed Boots buyout after being asked to

Gallant Capital, an LA private equity firm formed by a pair of former Gores Group execs, is reportedly back fundraising eyeing up to $600m for its sophomore fund. The post Gallant Capital said to seek

Private capital funds of funds have continued their "phenomenal run" with a 14-quarter streak of outperforming the rest of the private capital universe, new data from PitchBook shows. The post Fund of funds continue ‘phenomenal

US pension fund giant the New York State Common Retirement Fund has revealed another $1.38bn of alternatives commitments, including to a pair of Francisco Partners funds. The post US pension giant NYSCRF backs Francisco Partners

Global buyout giant Clayton, Dubilier & Rice and TPG Capital has agreed to take animal-health technology company Covetrus private at $4bn valuation. The post CD&R, TPG team up for $4bn-Covetrus take private deal first appeared on

Venture capital giant New Enterprise Associates has hauled in more than $5bn across its latest pair of hefty fundraises. The firm has picked up capital close to its $2.9bn target for a new early-stage investment fund

Venture capital major Andreessen Horowitz has doubled down on its belief in the future of the cryptocurrency market by hauling in $4.5bn for a new fund. The post Andreessen Horowitz raises huge $4.5bn crypto fund

FFL Partners has raised just over $900m for the final close of its fifth flagship fundraise - its first since beginning its management succession process from its co-founders. The post FFL Partners closes $917m Fund

SYN Ventures, a VC house focused on security and cybersecurity, national defense, privacy, regulatory compliance and data governance, has closed its second fund on $300m. The post Security, privacy-focused SYN Ventures hits $300m Fund II

Real estate investor Buckingham Companies has hit a $215m final close for its second value-add multifamily fundraise, as well as reaching a first close for a $160m-targeting development fund. The post Buckingham eyes $1bn of

The $10bn-managing Rhode Island State Investment Commission has picked out Advent International's $25bn megafund among its latest alternatives commitments. The post Advent’s $25bn megafund among new Rhode Islands SIC alternatives commitments first appeared on AltAssets

Private equity house Quad-C Management has hit new fundraising heights by bringing in about $1.7bn for the final close of its tenth flagship investment vehicle. The post Quad-C soars to $1.7bn for tenth flagship fundraise, well

AfricInvest has closed its biggest ever fund on more than $400m, targeting African mid-cap companies. The post AfricInvest beats hard cap for biggest-ever fundraise, eyes African mid-cap deals first appeared on AltAssets Private Equity News.

Credit and real estate investment major Angelo Gordon has beaten its $3bn target for its second credit solutions fund after seven months in the market. The post Angelo Gordon soars past $3bn goal for second

Miami-based private equity house Trivest Partners has raised more than $1.5bn across its latest two funds - a hefty increase compared to their predecessor vehicles. The post Trivest Partners ups fund sizes again with over

Sovereign Capital has hired Clearwater International to explore a sale of UK-based healthcare staff agency Nurse Plus, two sources familiar with the situation said.

Recent Comments