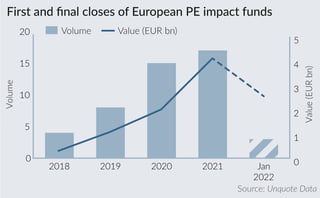

PE impact fundraising surpasses EUR 4bn in 2021

European GPs raised EUR 4.1bn across 17 first and final closes in 2021 for vehicles focusing on impact-driven investments, with EUR 2.56bn raised in January 2022 alone, according to Unquote Data.

European GPs raised EUR 4.1bn across 17 first and final closes in 2021 for vehicles focusing on impact-driven investments, with EUR 2.56bn raised in January 2022 alone, according to Unquote Data.

Software-focused private equity heavyweight Thoma Bravo is officially back in the market for the follow-up to its $17.8bn Fund XIV vehicle, having picked up a commitment from the Texas County & District Retirement System. The

Spanish private equity firm Abac Capital has sold all of the share capital of dietary company PronoKal to Nestlé Health Science.

Polaris Private Equity has hired EY as sell-side adviser on the GP's exit of Det Danske Madhus, a Danish catering company, five sources familiar with the matter said.

TA Associates is getting ready to sell French insurance broker Odealim Group in the second half of the year, three sources familiar with the matter said.

Tech-focused buyout giant Silver Lake has picked up a new commitment to its seventh flagship fundraise, which follows the $20bn Fund VI it closed at the end of 2020. The post Silver Lake’s follow-up to

Tikehau Capital has stated in its annual results that it raised EUR 6.4bn in 2021, marking a 53% increase on its previous three-year average.

Spanish alternative asset manager Clave has launched an €80m fundraise targeting early-stage technology transfer projects linked to knowledge-generating centers in the healthcare field. The post Spain’s Clave launches €80m-targeting fundraise aimed at healthcare tech knowledge first

Oaktree Capital has hit a $3bn final close for its third globl real estate debt fund, making it more than a third larger than its predecessor vehicle in the strategy. The post LPs flocking to

London-based private equity major BC Partners has reportedly fallen well short of its €8.5bn goal for its new flagship buyout fund after struggling to persuade some of its long-term backers to re-up. The post BC

The French large-cap pipeline will have a new joiner as Omers is preparing to exit French calibration services specialist Trescal in H2 this year, four sources familiar with the matter said. The Canadian pension fund

Upstream oil and gas investor North Hudson Resource Partners has beaten its target for a new fundraise looking to develop non-operated oil and gas assets in onshore US basins. The post Upstream oil, gas investor

Healthcare-focused private equity firm ArchiMed has sold health ingredients developer Fytexia to food retail group Associated British Foods, netting a 4x return.

Five Arrows Growth Capital has led a EUR 80m fundraising round for French digital occupational healthcare company Padoa.

Global buyout giant Carlyle saw its asset under management surge 22% in the last financial year to more than $300bn amid a surge in fundraising activity. The post Carlyle sees AUM soar past $300bn amid massive

Secondaries private equity major Coller Capital has raised what is believed to be the biggest LP-backed fund dedicated to credit secondaries through a $1.4bn final close. The post Coller Capital destroys fundraising target with $1.4bn

The clouds parted for EMEA-based deal-makers in 2021, as M&A activity in the region charged to its highest annual value since 2007, writes Jonathan Klonowski.

Recent Comments