Advent begins Idemia premarketing ahead of summer sale launch

Advent International has begun premarketing Idemia as it readies a summer exit from the French biometrics specialist, four sources familiar with the matter said.

Advent International has begun premarketing Idemia as it readies a summer exit from the French biometrics specialist, four sources familiar with the matter said.

Mid-market sponsor Inflexion has agreed to sell Global Reach Group, a UK-based foreign exchange specialist, to Fleetcor Technologies, a US-listed business payments company.

Apollo Global Management is said to have teamed up with Mukesh Ambani's Reliance Industries to make a binding bid for UK chemist chain Boots, which values the company at £5bn to £6bn. The post Apollo,

Oakley Capital Fund IV has agreed to sell its majority stake in Contabo, a Germany-based Cloud hosting platform used by SMEs, with its Fund V reinvesting alongside new majority shareholder KKR.

Nordic private equity firm Axcel has sold Denmark-based European Sperm Bank to UK family office Perwyn, according to a company announcement.

Levine Leichtman Capital Partners has sold Hand & Stone Massage and Facial Spa to Harvest Partners after seven years in its portfolio. The post Levine Leichtman ends seven-year Hand & Stone Massage ownership with exit to

UK-based sponsor Foresight Group has announced that it is exiting software provider Codeplay to a US corporate buyer, subject to regulatory approvals.

Graphite Capital has sold its stake in Random42, a leading medical animation studio, to US-based medical communications agency Lockwood Group.

UK mid-market buyout house Graphite Capital has exited scientific animation producer Random42 in a trade deal to The Lockwood Group. The post Graphite Capital exits scientific animation producer Random42 after five years first appeared on AltAssets Private

Mid-market sponsor Inflexion has agreed to sell Goals Soccer Centre (Goals) in a transaction with the football arena operator’s founding management team, Barry and Ian McDermott.

Baird Capital has announced the sale of online safety and crisis monitoring service Crisp Thinking Group to US-headquartered professional service provider Kroll.

European investor Verdane has exited legal and finance software Scanmarket after doubling its annual recurring revenue. The post Verdane exits legal and finance software Scanmarket after doubling ARR first appeared on AltAssets Private Equity News.

Private equity giant Blackstone is said to be nearing a deal to buy pharmaceuticals and regulatory consulting business Advarra from Genstar Capital at $5bn valuation. The post Blackstone near deal to buy Advarra from Genstar

Guggenheim Investments and Oak Hill Advisors have participated in a funding round in insurance broker Acrisure, valuing the company at $23bn. The post Guggenheim participates in Acisure funding round at $23bn valuation first appeared on

Great Point Partners Exits Portfolio Company Bionova Scientific(PRWeb June 01, 2022)Read the full story at https://www.prweb.com/releases/2022/6/prweb18712442.htm

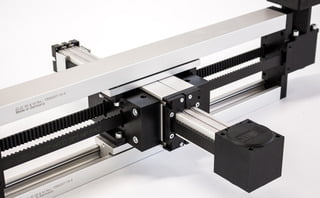

IK Partners is to exit Germany-headquartered modular electric linear motion systems producer Bahr Modultechnik in a EUR 98m trade sale to IMI, a UK-based engineering company.

Pan European buyout house IK Partners has agreed to exit Small Cap II portfolio Bahr Modultechnik to IMI, valuing it at a €98m enterprise value. The post IK Partners exits Small Cap II portfolio Bahr Modultechnik

Private equity firm Livingbridge has hired PwC to explore a sale of its British home care business Helping Hands, according to two sources familiar with the situation.

TDR Capital and Mohsin and Zuber Issa – the founders and co-CEOs of petrol station forecourt retailer business EG Group – are considering to walk away from its proposed Boots buyout after being asked to

Global buyout giant Clayton, Dubilier & Rice and TPG Capital has agreed to take animal-health technology company Covetrus private at $4bn valuation. The post CD&R, TPG team up for $4bn-Covetrus take private deal first appeared on

Recent Comments