Palatine exits Veincentre in SBO to CBPE

Palatine has sold its stake in UK-based varicose vein treatment clinic chain Veincentre to CBPE Capital.

Palatine has sold its stake in UK-based varicose vein treatment clinic chain Veincentre to CBPE Capital.

The media production company behind recent box office hit Top Gun: Maverick has hit a $4bn valuation thanks to a new investment round led by private equity giant KKR. The post Top Gun: Maverick production

French sponsor Qualium Investissement is optimistic that the USD 1.8tn dry powder gathered by private equity funds will continue to support its strong exit returns despite the increasingly global gloomy economic forecast, said managing partner

Vitruvian Partners is reigniting its plans to exit UK-based aviation data firm OAG, four sources familiar with the situation said.

Oakley Capital Fund IV has agreed to sell part of its stake in Wishcard to EMZ Partners and IK Partners, which will be acquiring minority stakes in the German gifts and vouchers technology platform.

Siparex ETI and Bpifrance have exited French apparel retailer Le Temps des Cerises to co-founder and president Lylian Richardière; Trocadero Capital Partners, Turenne Groupe and Smalt Capital became minority investors in the deal.

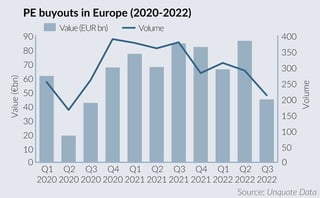

Private equity firms deployed the lowest amount of capital in Q3 2022 in Europe since COVID-19 struck, as tightening debt markets and a widespread correction to valuations point to further fierce headwinds.

European asset manager Aurelius has sold agrochemical contract development and manufacturing organisation Briar Chemicals to Indian trade buyer Safex. UK-based Briar has been part of the Aurelius portfolio since 2012, following a corporate carve-out transaction

European sponsor Aurelius has sold Briar Chemicals, an UK-based producer of agrochemicals and fine chemicals, to crop protection group Safex Chemicals India for approximately EUR 83m.

Michigan mid-market buyout house Auxo Investment Partners has scored an exit from M/G Transport Services through a sale to Maritime Partners. The post Auxo Investment seals M/G Transport Services exit to Maritime Partners first appeared

European mid-market buyout investor Stanley Capital Partners has scored a big exit success with the sale of Noden Pharma after just two years in its portfolio. The post Stanley Capital scores 151% IRR on its

Insight Partners has joined TA Associates as an investor in Aptean, a provider of enterprise resource planning and supply chain software. The post Vista exits 10-year investment in Aptean as Insight Partners buys in first appeared

Graphite Capital has engaged Harris Williams to advise on plans for a potential exit of Compass Fostering, three sources familiar with the situation said.

Veteran venture capital house CRV has raised $1.5bn across two new funds, including its first-ever $1bn early-stage vehicle. The post CRV raises first $1bn early-stage fund amid rising round sizes, valuations first appeared on AltAssets

Palatine Private Equity has offloaded its minority interest in Acora to LDC, the private capital arm of Lloyds Banking Group, less than three years into its investment in the UK IT managed services provider.

Silverfleet has agreed to sell its stake in TrustQuay, a provider of trust, fund and corporate services software, to Hg in an exit set to generate a 3.1x gross money multiple and an IRR of

Levine Leichtman Capital Partners has bought agribusiness workflow and data services provider AGDATA from Vista Equity Partners. The post Vista exits AGDATA after eight years to Levine Leichtman Capital Partners first appeared on AltAssets Private

The managers of Novalpina 1 have made a major step in the winding down of the liquidated fund by selling crown jewel asset Laboratoire XO to Stanley Capital.

Italian sponsor Assietta Private Equity has appointed Equita and Houlihan Lokey to handle the sale of Italian natural cosmetics producer Naturalia Tantum, a source close to and a source familiar with the situation said.

Microcap investor Shore Capital Partners has agreed to sell eye care management services business EyeSouth to fellow private equity investor Olympus Partners. The post Shore Capital exits EyeSouth to Olympus Partners after huge expansion programme first

Recent Comments