Tenzing sells CitNOW to Livingbridge; reaps 9.6x return, 74% IRR

Tenzing has reaped 74% IRR and a 9.6x multiple on invested capital in its exit of CitNOW Group to Livingbridge.

Tenzing has reaped 74% IRR and a 9.6x multiple on invested capital in its exit of CitNOW Group to Livingbridge.

Ardian has sold its majority shareholding in Lyon-based Opteven, a roadside assistance and breakdown insurance provider, to Apax Partners.

CVC has agreed to buy into Spectrum Medical at a valuation of up to £1bn. The post CVC agrees Spectrum Medical buyout at £1bn valuation first appeared on AltAssets Private Equity News.

Global sustainable infrastructure investment major Actis has agreed to sell Africa's largest pure play renewable energy independent power producer Lekela. The post Actis seals exit of Africa’s largest pure-play renewable energy independent power producer first

Bridgepoint has appointed Macquarie to oversee its exit of Cambridge Education Group's (CEG) private equity backer, a UK-based pathway programme provider, five sources familiar with the situation said.

UK private equity investor Pelican Capital is celebrating a roughly 6.5x return through the exit of parking technology provider YourParkingSpace. The post Pelican Capital scores 6.5x return through savvy YourParkingSpace investment first appeared on AltAssets

Five Arrows has sold Hygie31, a France-based pharmacy chain that includes low-cost brand Laf Sante, to Latour Capital in an auction preempted by the French sponsor.

Bain Capital has mandated Robert W. Baird and Barclays Capital to sell Dutch pram developer Bugaboo International, according to two sources familiar with the situation.

Berlin-based insurtech platform Wefox has reached a USD 4.5bn valuation in a Series D round backed by existing investors, with sovereign wealth fund Mubadala leading the equity raise.

BC Partners is looking to exit IT Presidio at more than $4bn, including debt, Reuters reported quoting two people familiar with the matter. The post BC Partners looking at $4bn deal to divest IT company

Mobeus Equity Partners has exited Access Partnership, a provider of technology advisory in the fields of regulation and public policy, in a management buyout backed by Mayfair Equity.

Eurazeo has closed the sale of its majority stake in Orolia to aircraft parts manufacturer Safran in a deal that generated cash proceeds of EUR 189m.

Finnish private equity firm CapMan Buyout has exited local industrial group Fortaco to One Equity Partners while also acquiring cybersecurity group Netox.

Consumer and technology investor Mayfair Equity Partners has agreed to fully exit portfolio company Talon Outdoor to Equistone; the company’s management will retain a meaningful stake.

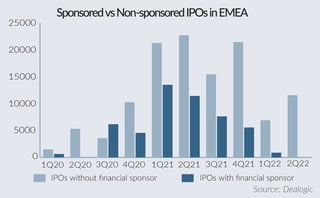

Despite a wave of IPO postponements in 2022, corporate sellers are adjusting to new valuation benchmarks and will be the most likely to pursue IPOs for their assets this year.

August Equity has sold Amtivo, a provider of accredited certification to companies across 23 countries, to Charterhouse Capital Partners.

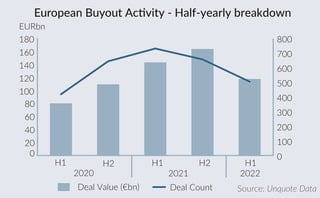

Following an almost too-good-to-be-true year in 2021, the outbreak of war in Ukraine and an impending recession are bringing a dose of realism to the world of private equity.

Gresham House Ventures has sold its majority stake in Media Business Insight (MBI), a UK-based content, insight, and events company for the creative media industry, in an off-market transaction to GlobalData, an AIM-listed data and

European GP Aurelius has sold Hammerl, a German manufacturer of blown film products, to construction material group Karl Bachl.

Blackstone and the Canada Pension Plan Investment Board have agreed the buyout of Genstar Capital’s Advarra, in a deal believed to value the business at about $5bn. Genstar and Linden Capital Partners will continue to

Recent Comments