Sidekick spinoffs: Insurtech scale-ups attract PE interest

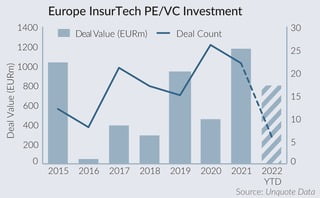

Insurtechs have long been overlooked by investors as fintechs’ smaller and less-attractive sidekicks. But now, as private equity firms search for rising stars, it seems some scaleups are finally getting to star in their own