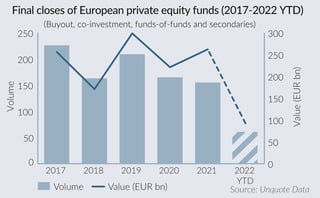

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Amidst a crowded fundraising market and a tough macroeconomic environment, final closes of private equity funds in Europe to date in 2022 have struggled to keep up with the same period in 2021. However, a